Hotly mentioned by the foreign investor community on Twitter recently, the $QNT coin has grown by more than 20% in the past 5 days, a number that stands out compared to the general market at the moment. Let's analyze the reason behind with Holdstation!

What is Quant Network?

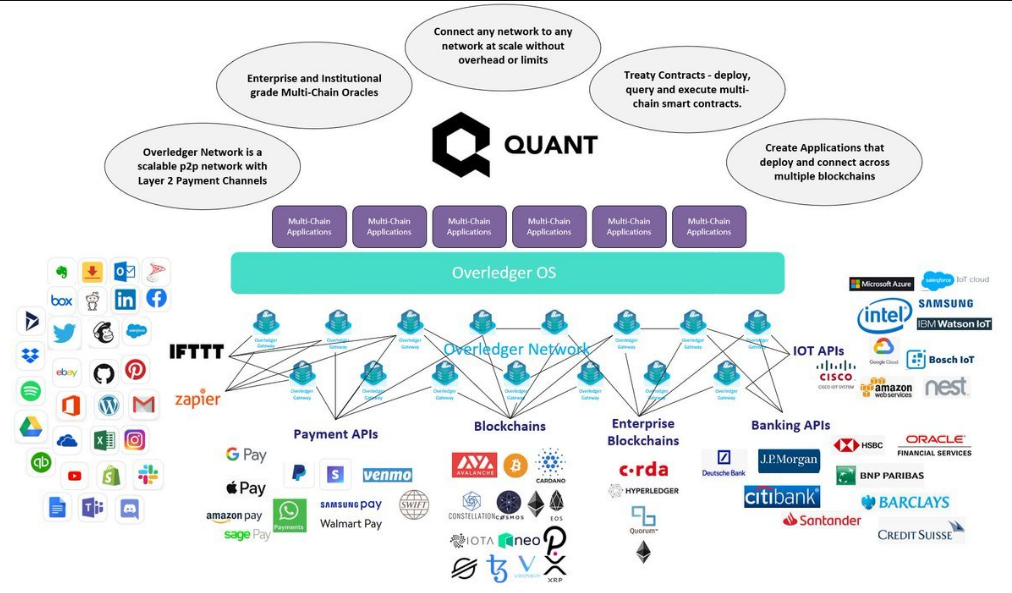

Quant Network is an infrastructure project built to solve many of the "Compatibility" related issues facing the blockchain world.

Simply put, this is the ability of a computer system or software to easily connect and exchange information, which will open up a new future for the generation of multi-chain blockchain - an application can launch and store data on many different blockchains, thereby helping to expand the ecosystem.

Currently, there are projects that do the same thing as Polkadot or Chainlink, so what is the difference between Quant Network? If $DOT and $LINK are aimed at blockchain-to-blockchain compatibility, then $QNT's audience is broader, whether it's a special purpose chain, a smart contract chain, or a security chain - they can all interact with each other.

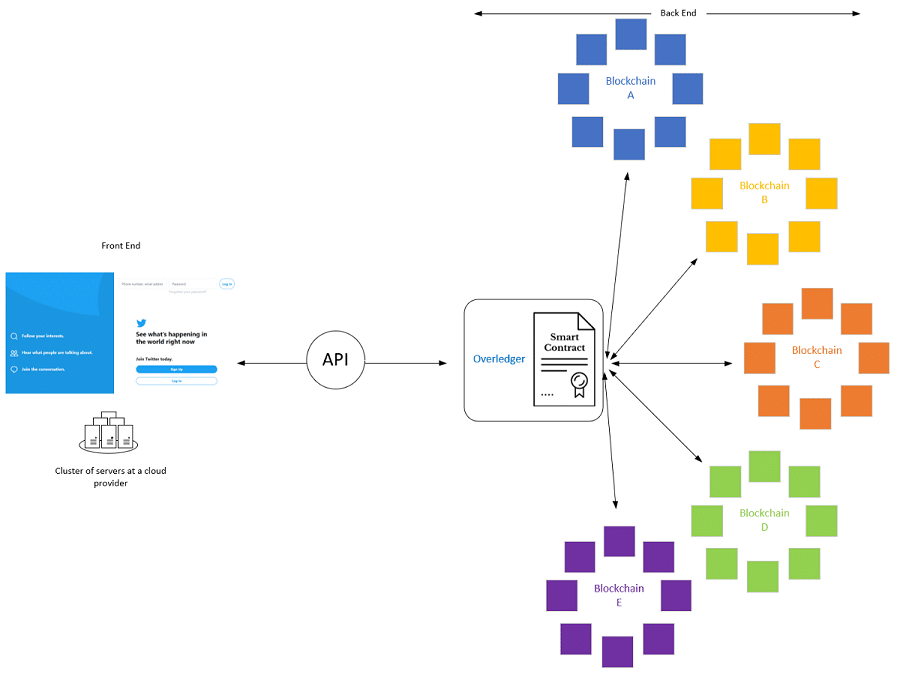

To accomplish this, Quant Network applies Overledger technology - cross-chain multi-chain data transfer with other networks. Overledger is similar to the Windows or macOS of the blockchain network.

$QNT provides continuously updated data and connects the banking system with each other. Like Google Play and Apps Store, the Quant ecosystem allows developers to build multi-chain applications (mApps). Each mApp can deploy multiple smart contracts that work together on different blockchains.

Some other potential applications of Overledger: Finance, Health, Smart Vehicles, Supply Chain, IoT, Insurance,...

Development team

The development team is well qualified and has many years of experience.

- CEO Gilbert Verdian has worked for more than 3 governments and leading private FinTech services. Having a good relationship with many central banks this can be helpful in supporting CBDCs (Central bank digital currency).

- COO Lara Verdian has a background in Healthcare and is a former Chief Economic Officer Deloitte - Big4 in audit.

- CMO Andrew Carrier has 8 years of experience at the Association for Global Interbank Financial Telecommunication as a Global PR Manager and 3 years as Marketing Manager for Deutsche Bank.

Tokenomics

Currently the Tokenomics $QNT model is non-inflationary with many use cases. Total supply 14 million $QNT and unlocked for investors; team holds 21%.

Businesses and users who want to adopt Overledger or applications that use Overledger need $QNT to pay the license fee.

Thus, the value of $QNT will depend on supply and demand and the discharge force is very limited

The "big" partners

KPMG - Big4 in Auditing - provides consulting services to hundreds of large enterprises worldwide on digital strategy and new technologies. And from this partner Quant Network can reach many companies that need the compatibility and use of Overledger.

NEXI is Europe's leading credit card solution, connecting with more than 1,000 financial institutions and processing over $21 billion in transaction value each year.

Not only that, but Quant Network also has a good relationship with Oracle - the largest provider in the technology market today - and this corporation has integrated $QNT into the blockchain infrastructure and proposed this solution to more than 430,000 customers through the Cloud Computing market.

Why is there a sudden "Pump" and what to expect?

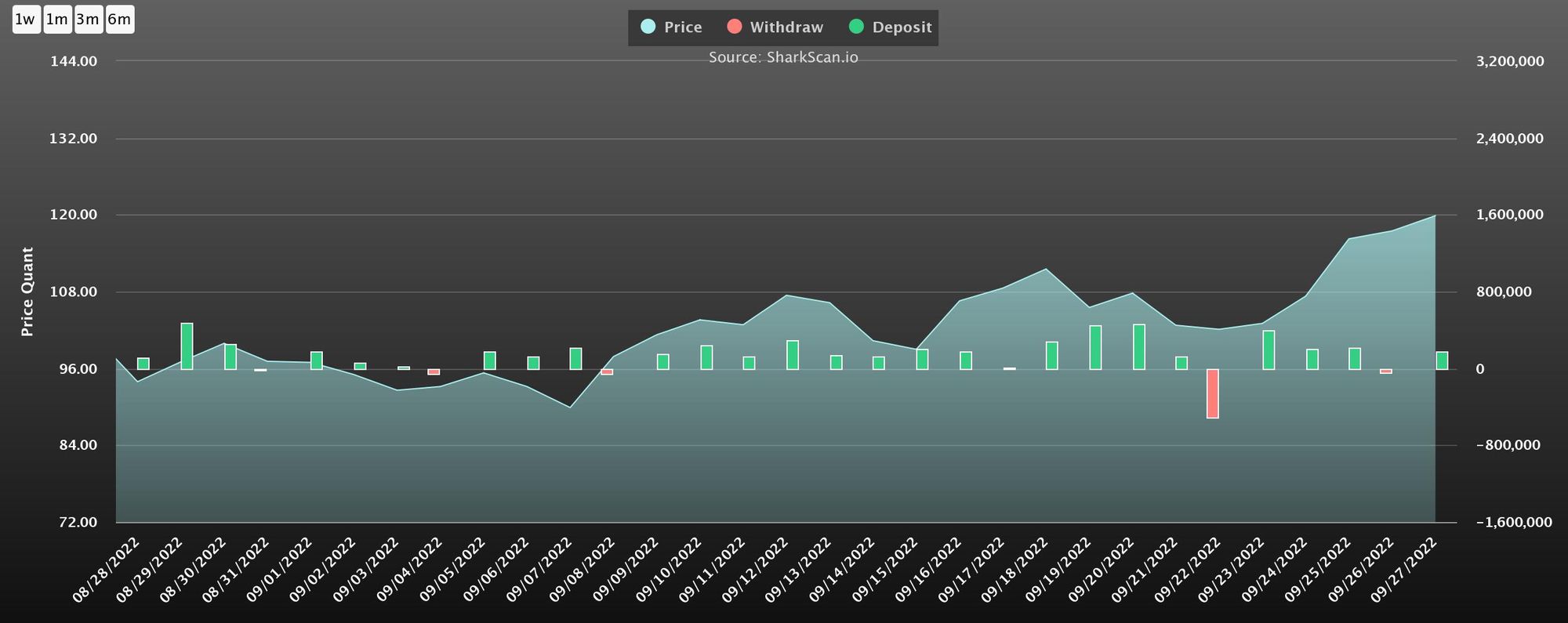

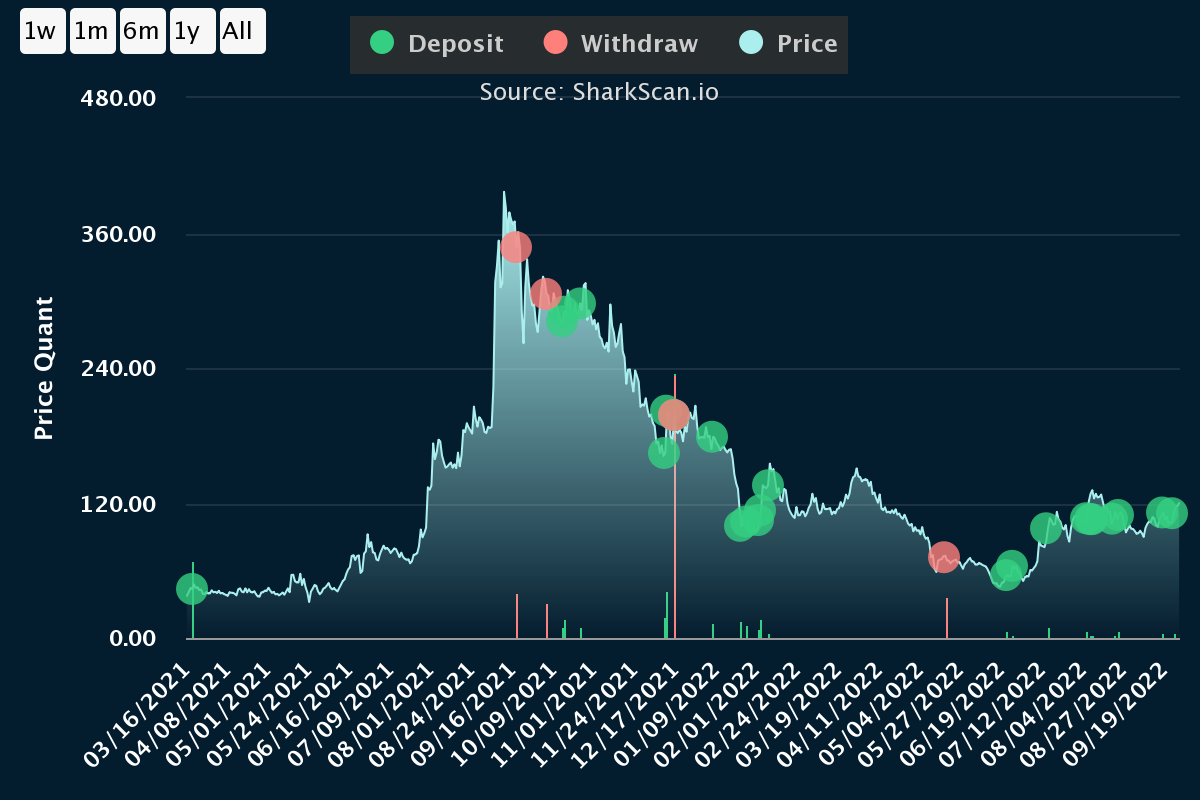

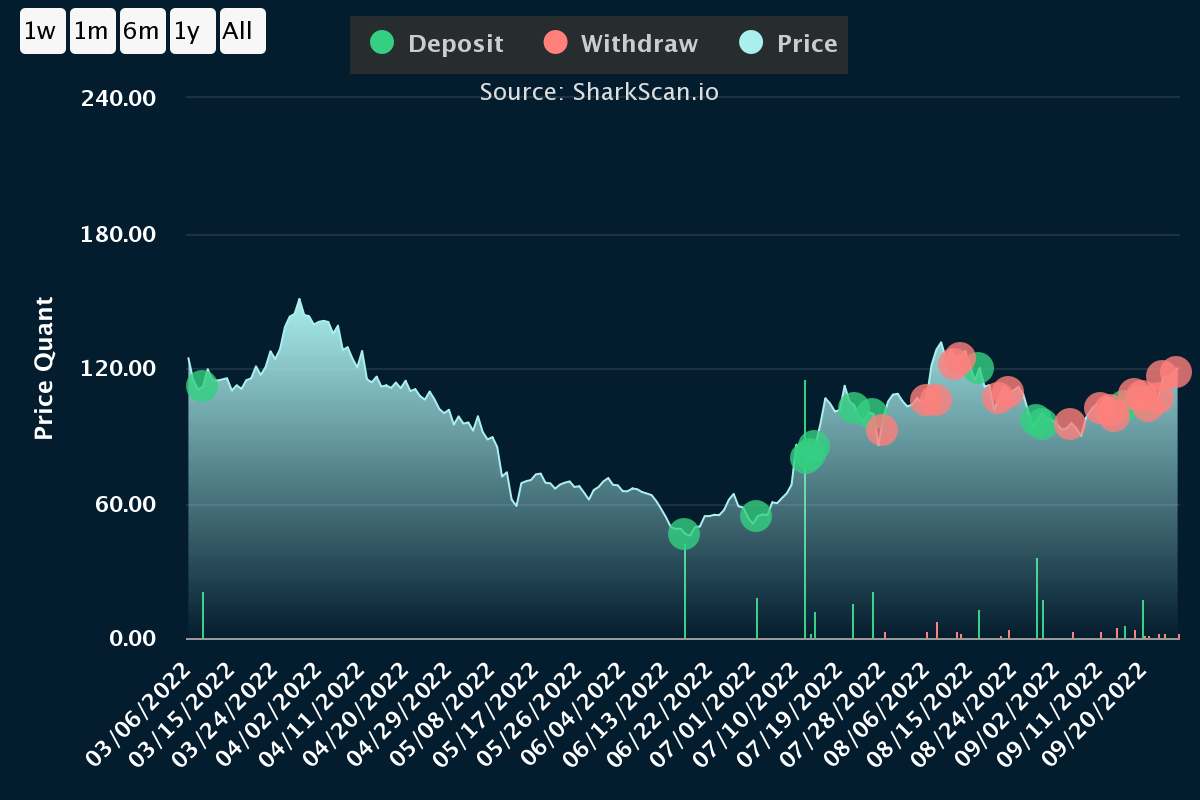

Only in the past 10 days, the cash flow to buy $QNT of Ethereum sharks is quite large when many days in a row the cash flow coefficient is positive, according to Sharkscan.

A shark with a total net worth of more than $82 million has continuously accumulated $QNT with the last time on September 24 - 800 QNT equivalent to $88,744, and currently holds more than $5 million worth of QNT. The average bid and ask prices of $119 and $179, respectively, indicate that this wealthy investor is making substantial profits. In addition to $QNT, the portfolio also owns many other tokens such as $ETH, $SHIB, $VRA, $SAND, and $MATIC, ... so it can be ruled out this is a customer or company using Quant's products.

Elsewhere, an investor took profits of the recent rally but still owns QNT worth more than $6 million. This shows that this is a project for long-term investment.

The recent growth can be explained by positive news when Oracle - a leading partner of Quant Network - announced the organization of a conference with the theme "The multi-cloud area has begun" taking place on October 17 - 20.

Discover why multicloud interoperability is the next important step in the evolution of cloud computing at #CloudWorld in Las Vegas, Oct. 17-20. https://t.co/7dwxNsHCf0 pic.twitter.com/90R7PmZ5aR

— Oracle (@Oracle) September 24, 2022

⇒ Oracle is applying interoperability technology from Quant Network, so the potential for more and more customers to exploit Quant Network increases.

Summary

Quant Network is really a quality project that can be invested in the long term when solving practical problems as well as having a top team and partners. In the short term, the growth wave is still ongoing (it may be until the day of the conference if the macro situation is not too bad), and investors should consider being able to come up with an appropriate strategy.