In previous articles, Holdstation introduced readers to the Delta-Neutral Yield strategy, which is a strategy to create aggregate real productivity from different platforms for users without being affected by price fluctuations. . The protocols introduced in the previous article include: Umami Finance, GMDProtocol, Rage Trade. However, in today's article, Holdstation will introduce to readers Mugen Finance - Real Yield project build on top of GMX using LayerZero to create liquidity for GMX.

Overview

Mugen Finance is a "Yield Management" platform by connecting multiple decentralized platforms together through LayerZero's technology. And simplify receiving interest through holding $MGN – the project's governance token.

The platform is geared towards decentralization through a community-run "Treasury". Creating diversity and transparency in the face of many collapses of CeDeFi projects today

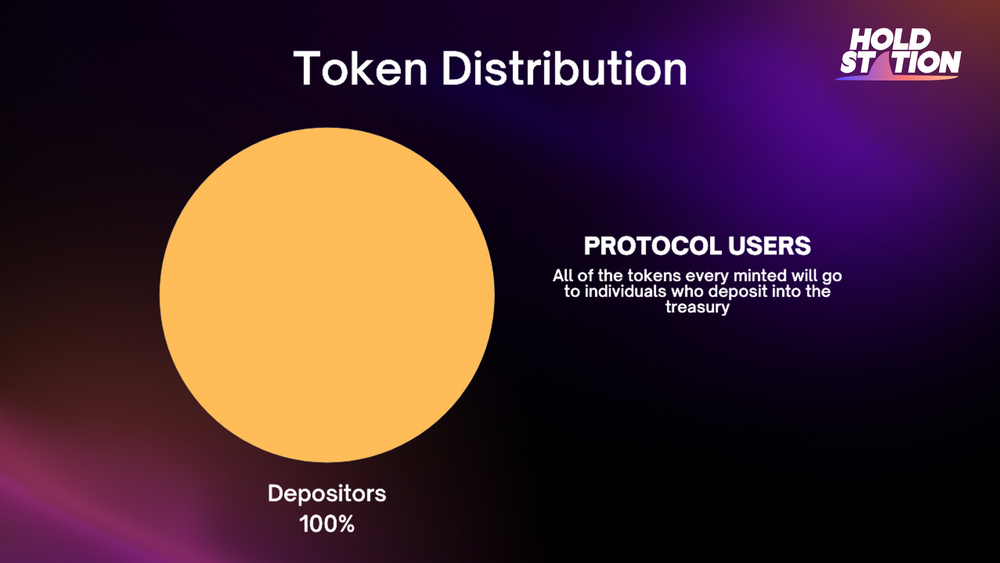

Tokenomic

Mugen Protocol starts with "zero" tokens. All tokens are generated through Bonding in $USDC. All $USDC is transferred to the “Treasury” of the platform. After each Bond $MGN, the price will be raised higher so if you decide to invest in the project you should find out in advance about the price of $MGN in the open market and the Bond price.

Bonding

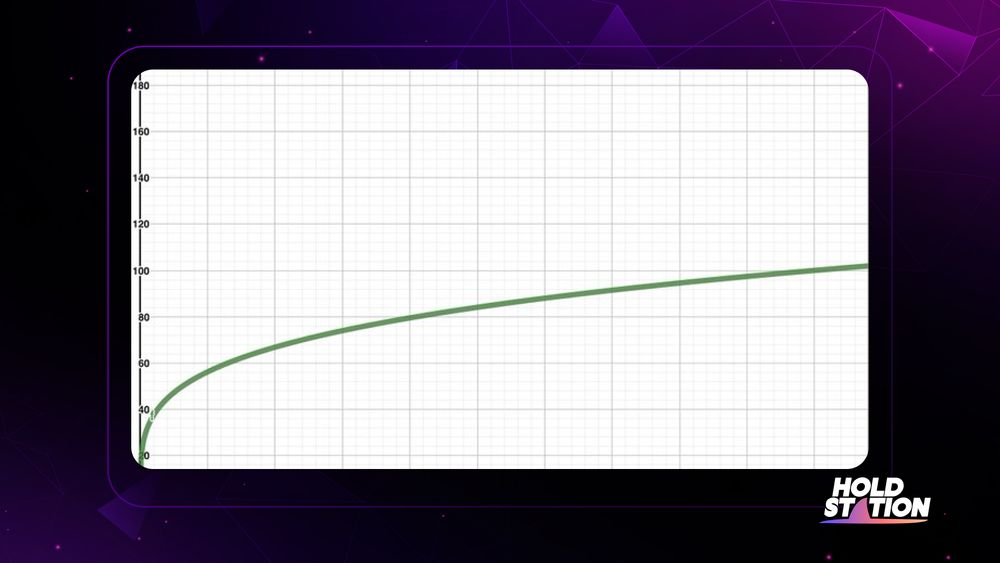

Bonding mechanism here is understood as a mechanism to create more tokens into the supply with a price that varies according to the total supply of that token. The funds used to pay for Bonding will be deposited into the Treasury and used in profit-making strategies (Protocol Owned Liquidity - POL). The more tokens in circulation, the higher the Bonding price will be.

Features of $MGN

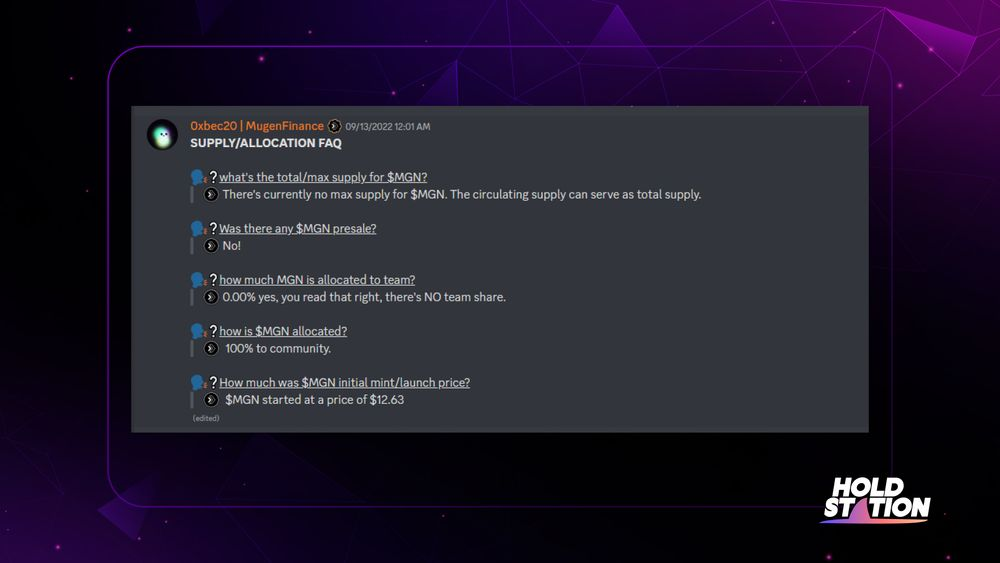

- There is no limit to the total supply, however will be limited to the increasing Bond price.

- Allocation of tokens 100% to the community, no allocation to the team or any VCs

- The first Bond price is $12.63

Formula

The price of $MGN Bonding is calculated by the formula: y = x^(1/4)

According to the formula, the price of $MGN will increase according to a curve pattern and will slow down for quite a while. This ensures new users a fair price while the project's Tresuary continues to grow.

Product

Currently, Mugen Finance has 3 core products:

xMGN

User Stake $MGN and get back $xMGN as deposit receipt. The reward for this product is $ETH earned from the profits coming from the project's Tresuary.

stMGN

Similar to xMGN, however the $ETH bonus in this product will be used to buy $MGN and continue to accrue to the previous deposit.

Strategies

All $USDC that is sent by Bonding users $MGN is transferred directly to the Treasury, then the team will generate votes from the users to use the Treasury to invest in projects.

Currently, Treasury are being used to provide liquidity to GMX through $GLP for $ETH rewards

Users can calculate their reward through the formula: (TVL x APY of the strategy x 0.9) / (Total Supply x Market Price x Percentage of Tokens Staked)

A little analysis then if in perfect condition: $GLP APY, total supply, percentage of staked $MGN and total Treasury do not change but the price of $MGN decreases. The reward APY for $MGN Stakers will be increased and vice versa.

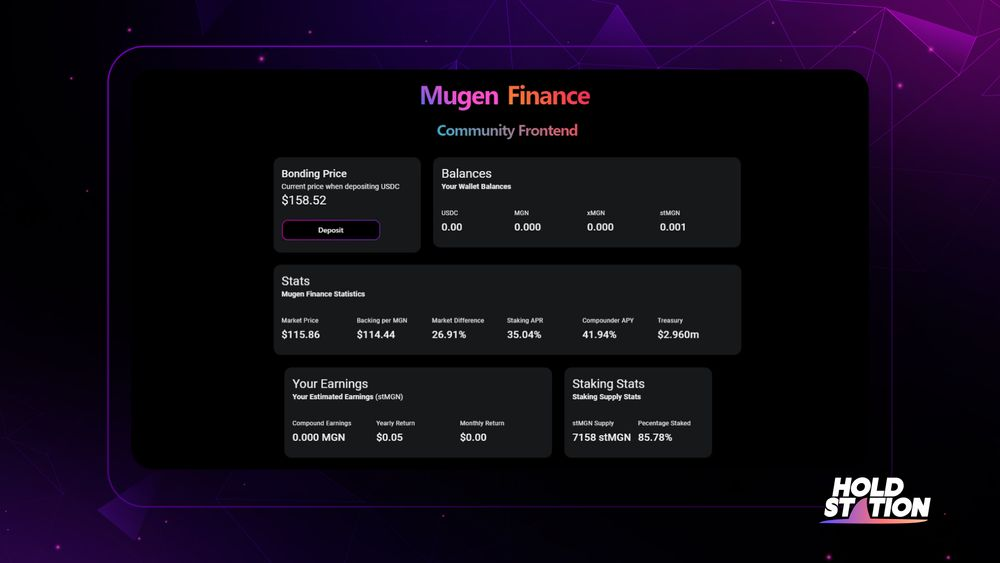

This leads to a formula that can calculate the fair value of an investment in $MGN: Total Value of Funds / Total Supply of $MGN

Example: The Fund is currently about 3M$ and the total supply is 25,863$MGN. So the fair value to buy $MGN calculated by the formula would be 3,000,000 / 25,863 = 115.99$

Roadmap

Important upcoming roadmaps of Mugen Finance

- Collaborate on more projects to diversify portfolios and increase productivity for users

- Use $xMGN as collateral at Lending platforms (Vesta Finance, Radiant Capital, ...)

- Cross-Chain Swap via LayerZero's OmniChain

Current Overview

Currently, Mugen Finance has points to pay attention to

- Total Supply: 25,863.69 $MGN

- Market capitalization: about 3M$

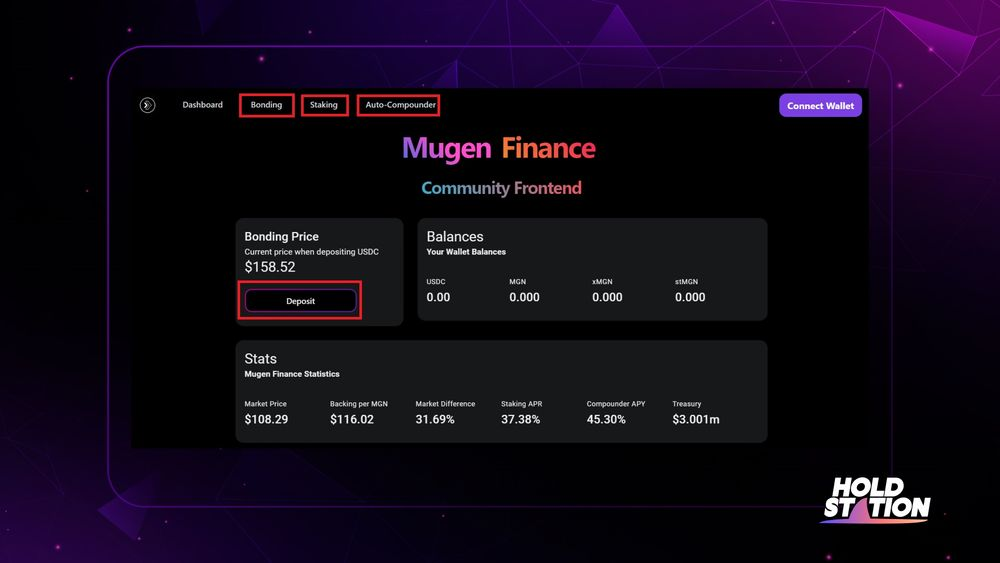

- Bonding Price: $158.52

- Funds: Approximately 3M$ is being used to invest in $GLP

- Tresury TVL/Supply: 114.44$

- Total $MGN locked: 85.78% of total supply

The project parameters you can see here

Instructions to Buy Tokens $MGN And Stake

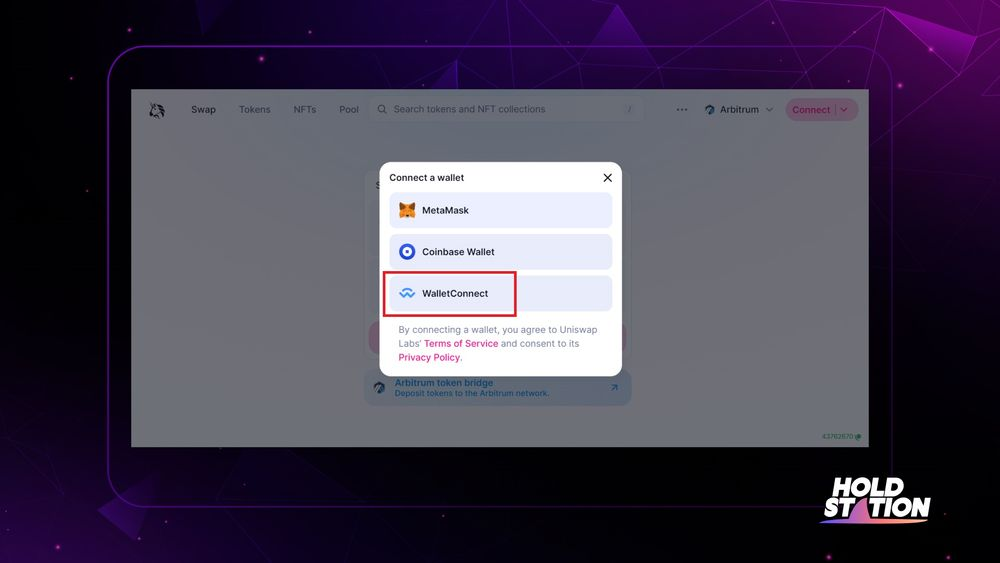

First you need to access UniSwap to buy tokens

Then connect to your personal wallet using QRCode

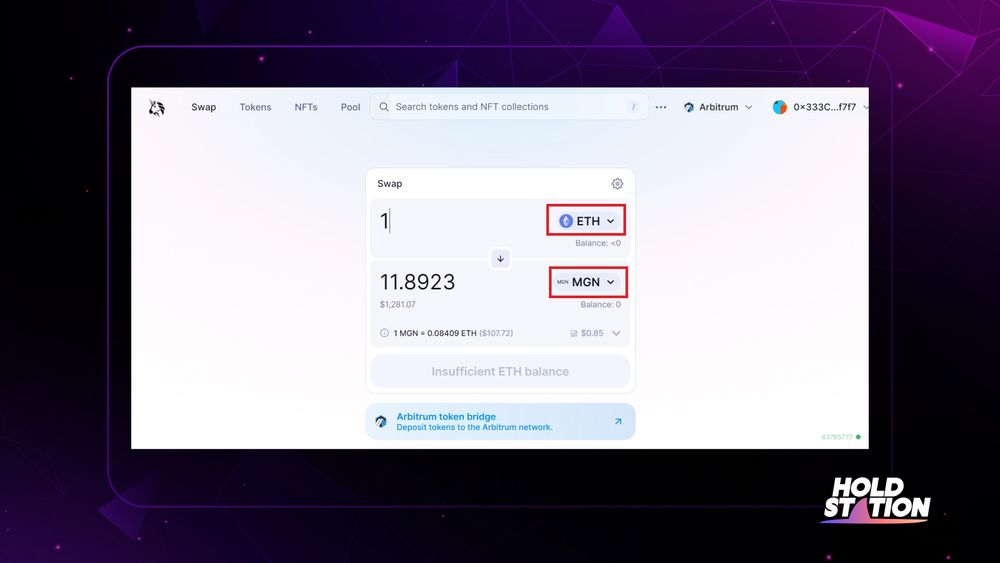

Then you proceed to Swap from $ETH or $USDC to $MGN to have the lowest slippage.

$MGN Contract Address: 0xFc77b86F3ADe71793E1EEc1E7944DB074922856e

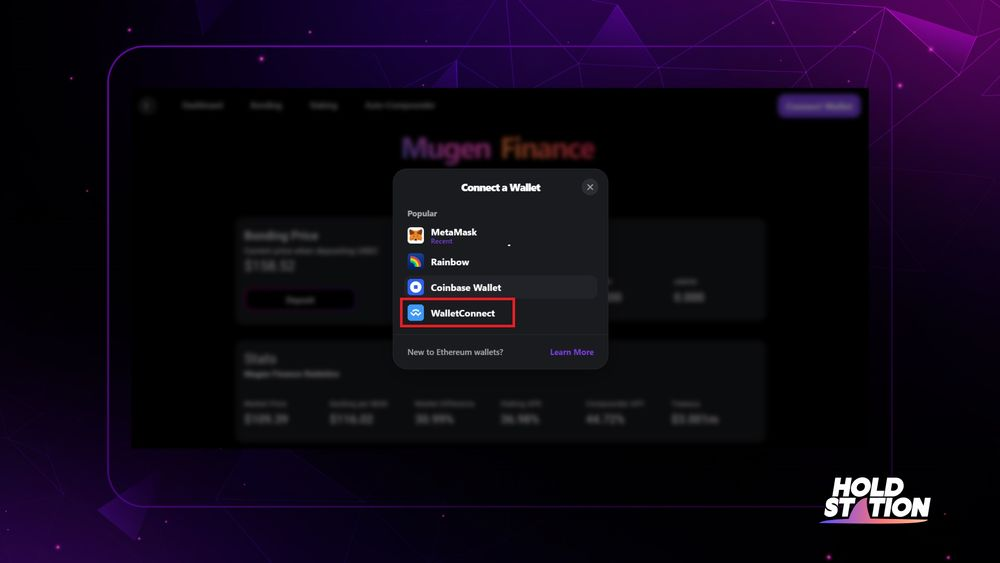

Once you have $MGN you can go to Mugen Finance's Dapp here

You connect the wallet to the Dapp similar to UniSwap

After that, you can Bonding or Staking to receive $ETH or "Cumulative" depending on your investment decision.

Investment Review

In my personal opinion, $MGN will hardly grow strongly in the short term because the Bonding mechanism limits price growth and creates more supply. However, in the long term, $MGN is still worth the investment with the possibility of sustainable growth from revenue.

Why does $MGN grow in the long run?

Reasons why $MGN can grow sustainably in the long term:

- Mugen's Treasury will grow with the amount of $MGN Bonding, from which the project can create more strategies to create better productivity for users.

- The reward from the project is $ETH and $MGN is bought back from $ETH – a sustainable Real Yield mechanism.

- The liquidity depth from OmniChain will help projects that are strategically built by Mugen to benefit from receiving liquidity from users on any Blockchain that LayerZero supports.

Note: Using Mugen Finance can give you a higher chance to get $ZRO airdrop from LayerZero Labs

However, Mugen Finance still has limitations on its absolute dependence on strategic platforms. If the investment strategies are not reasonable, it will lead to a deficit in the Project Fund and the rewards for users are no longer attractive.

Disclaimer:

The information, statements and conjecture contained in this article, including opinions expressed, are based on information sources that Holdstation believes those are reliable. The opinions expressed in this article are personal opinions expressed after careful consideration and based on the best information we have at the writing's time. This article is not and should not be explained as an offer or solicitation to buy/sell any tokens/NFTs.

Holdstation is not responsible for any direct or indirect losses arising from the use of this article content.