Famous DeFi products that most crypto users know such as: Curve Finance, AAVE, Sushi Swap, ... are platforms that have contributed a lot to the improvement of technology in DeFi products, but Activities such as liquidity mining have not yet yielded sustainable profits. Addresses the inherent limitations of DeFi 1.0. The Olympus DAO was born and became a classic example of DeFi 2.0. Let's learn about a classic model of DeFi 2.0 with Holdstation through this article!

What is Olympus DAO?

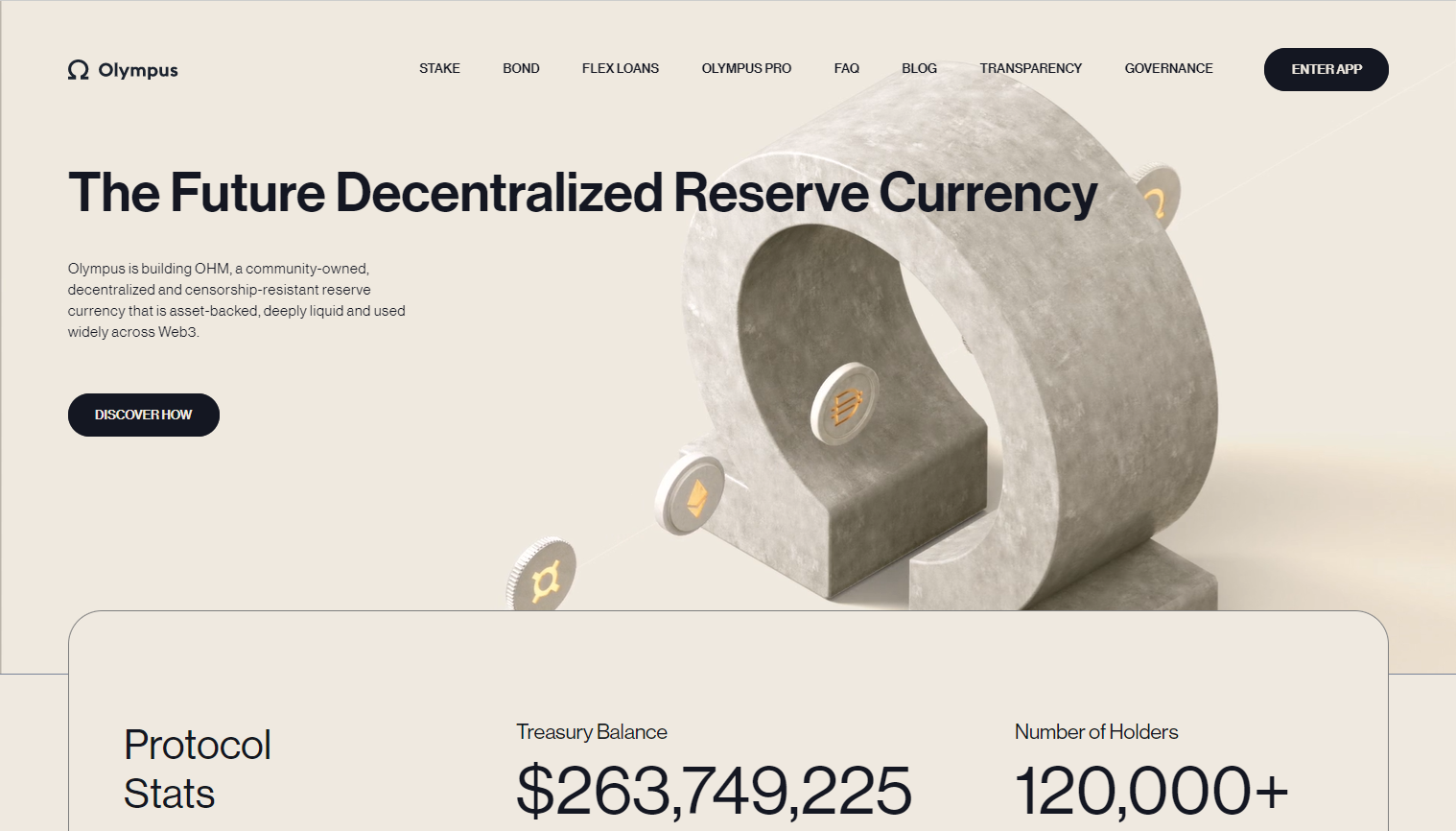

Launched in May 2021, Olympus is an OHM token-based currency reserve protocol, backed by a basket of assets within the Olympus Treasury. The goal of the project is to build a monetary control policy system that helps manage the performance of the project's OHM token. In which Olympus Treasury holds a wide range of assets including: $DAI, $FRAX, $LUSD, ETH and Liquidity Pool tokens such as OHM/DAI from SushiSwap

OlympusDAO Bond - an example of DeFi 2.0

The main competitive focus of the Olympus DAO is the application of traditional market bonds to the crypto market. While the method of managing the performance of the bonds will be the same as that of the OHM token, Olympus' bond structure will not be what the traditional market has done.

In the traditional market, bonds are generally like a loan. When a business or organization needs more capital, it may issue a bond that acts as a note for a loan for a certain period of time. During that period the business or organization must pay interest to its creditors. Usually, the interest on a bond is paid to investors on a quarterly basis.

In general, there are many different types of bonds such as government bonds, corporate bonds, mortgage bonds, etc. Since a bond is still a debt by nature, it still has some degree of risk. determined. Typical examples include credit risk or interest rate risk. If the bond issuer cannot afford to repay the debt, the bond may default. Therefore, the higher the bond yield, the greater the risk.

An Olympus bond differs from a regular bond in that it reflects the discount structure of a token sale. Instead of receiving interest like the traditional market, investors can sell their assets to Olympus treasuary to receive OHM tokens back at a more favorable price than usual (the discount is usually 5% or 10%). ). This process usually includes a token vesting period that takes place within 5 days (For example, OHM is priced at $1, then when the user buys $1 Bond, instead of receiving interest, the user will multiply the same $OHM. corresponding to that $1 Bond at a 10% sale price, the user only has to spend $0.9 for 1 OHM , but instead of receiving 1 OHM at a time, the user will receive 0.18 OHM every day until it runs out. vesting period 12 days) users can profit from this OHM token by staking OHM to receive interest or selling this OHM at a higher market price than the purchase price.

The sale of Olympus bonds will bring profits to the Treasury, over time, Olympus can accumulate more liquidity for liquidity pools on SushiSwap which Olympus calls "Protocol. Users of the ecosystem. Olympus can choose from different yielding strategies and bond types based on the ROI of each product, including DAI bonds, wETH bonds, FRAX bonds, and more.

Operation Model The Game Theory of Olympus DAO

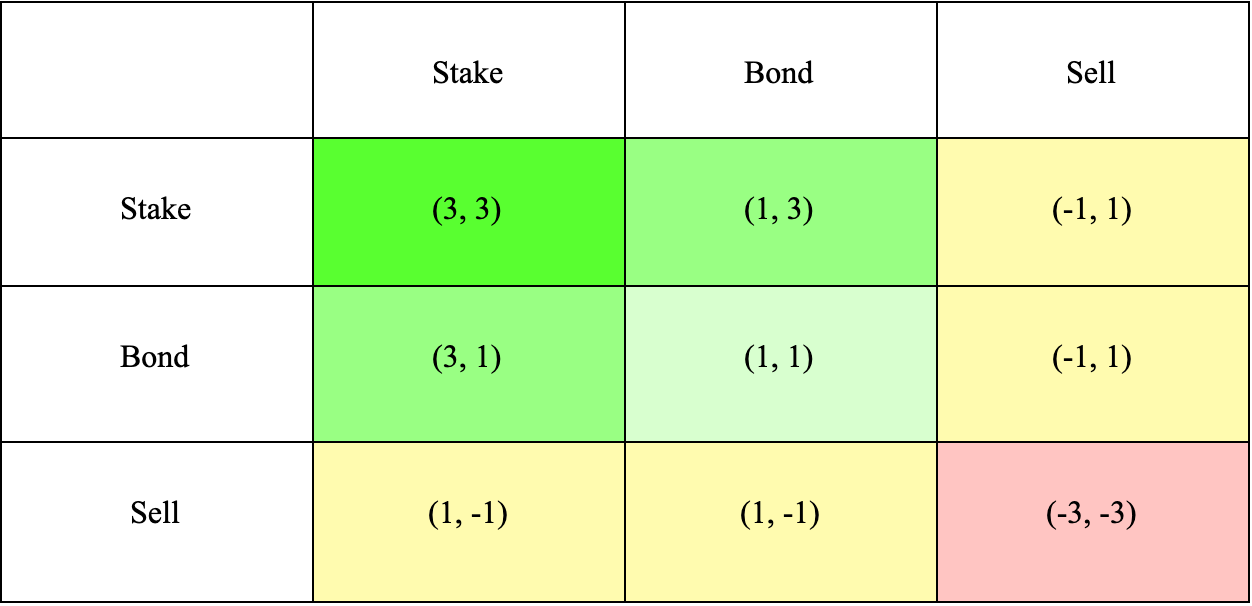

In the simplest model of Olympus will include two players with three actions:

Stake (Buy)

Bond

Sell

Bond will offer a discount of 1. Stake will push the price to +2. Selling pushed the price down -2.

Players are most likely to stake when they predict that the price will increase. Players are more likely to sell when they anticipate a price drop. And players are more likely to use Bond when they don't have a clear bias.

According to the theoretical reference value, when all players agree and stake will be the most profitable strategy for the entire OlympusDAO community with value (3,3). Much more optimal than the combinations Bond and Sell or Bond and Stake.

Thereby (3,3) became a famous meme in the community, promoting everyone to stake OHM and working very effectively, currently 71% of the total supply of OHM is being staked.

The Risk of Olympus Dao

Olympus claims that their Protocol Owned Liquidity and bond offerings will help mitigate or even solve today's liquidity mining problems. However, this is not without risk. For example, as the protocol continues to own more liquidity tokens, they have more centralized control and can adjust the OHM price accordingly.

As the OlympusDAO protocol is still in its infancy, macro market volatility can quickly impact investor sentiment and favor, especially regarding OHM's price and stability. This has been clearly demonstrated by the overall market's 3 consecutive quarters of decline, which has also contributed greatly to the price of OHM having split more than 100 times since its peak in October 2021.

In addition to the ponzi model of Olympus Dao, when the latter will buy the bond and increase the price of the token, those who have bought the bond before will be the beneficiaries, also making the current model of Olympus Dao. does not bring sustainability.

Conclusion

In general, the trend following 2.0 models are in very early stages when everything about cross-chain liquidity, temporary loss insurance, or any new use cases has the nature of overcoming Defi's disadvantages. 1.0 are only at the level of ideas or rudimentary implementation. The idea of a Defi 2.0 that will overcome the weaknesses of Defi 1.0 is entirely possible. However, it also needs time and supporting macro factors. With the current macro situation, it is not easy to hope for a new trend to lead the market to recover.