The year 2022 is a year of many changes that greatly affect the general economic situation of the whole world. Especially 2022 is a year of great crisis for the crypto market and causes many difficulties for investors. Before entering the new year with new hopes, let's review the remarkable news with Holdstation in the past year.

General situation of the world financial market

At the end of 2021, with the Covid-19 epidemic gradually being controlled, the world economy began to enter a recovery cycle, from that perspective, many analysts believe that 0% interest rates will continue to be extended to promote economic growth. propel this recovery. However, after continuously injecting money through stimulus and support packages into the overheated economy, banks began to face problems caused by "cheap money".

Accompanied by geopolitical uncertainties. On February 24, 2022, Russia launched a war with Ukraine, causing oil and food prices to be pushed up, causing demand-pull inflation, further increasing the general inflation situation and slowing the recovery of the global economy.

Inflation rose to the highest level in the past 40 years, and continued to cause negative effects, forcing Central Banks to take actions to contain and stabilize the economy and prevent a crisis. are latent. The US Federal Reserve (Fed) had to raise interest rates for the first time since 2018, and other central banks around the globe quickly followed suit.

Fed rate hikes

The monthly consumer price index (CPI) continuously increased, forcing the Fed to raise interest rates to reduce overall demand and curb inflation, while recovering the amount of "cheap money" that had hit the market in the past few months. during the past 2 years. In March 2022, the FED decided to raise the basic interest rate to 0.25 - 0.5%, the first time since 2018 and the first time the interest rate has been adjusted since the Covid-19 pandemic.

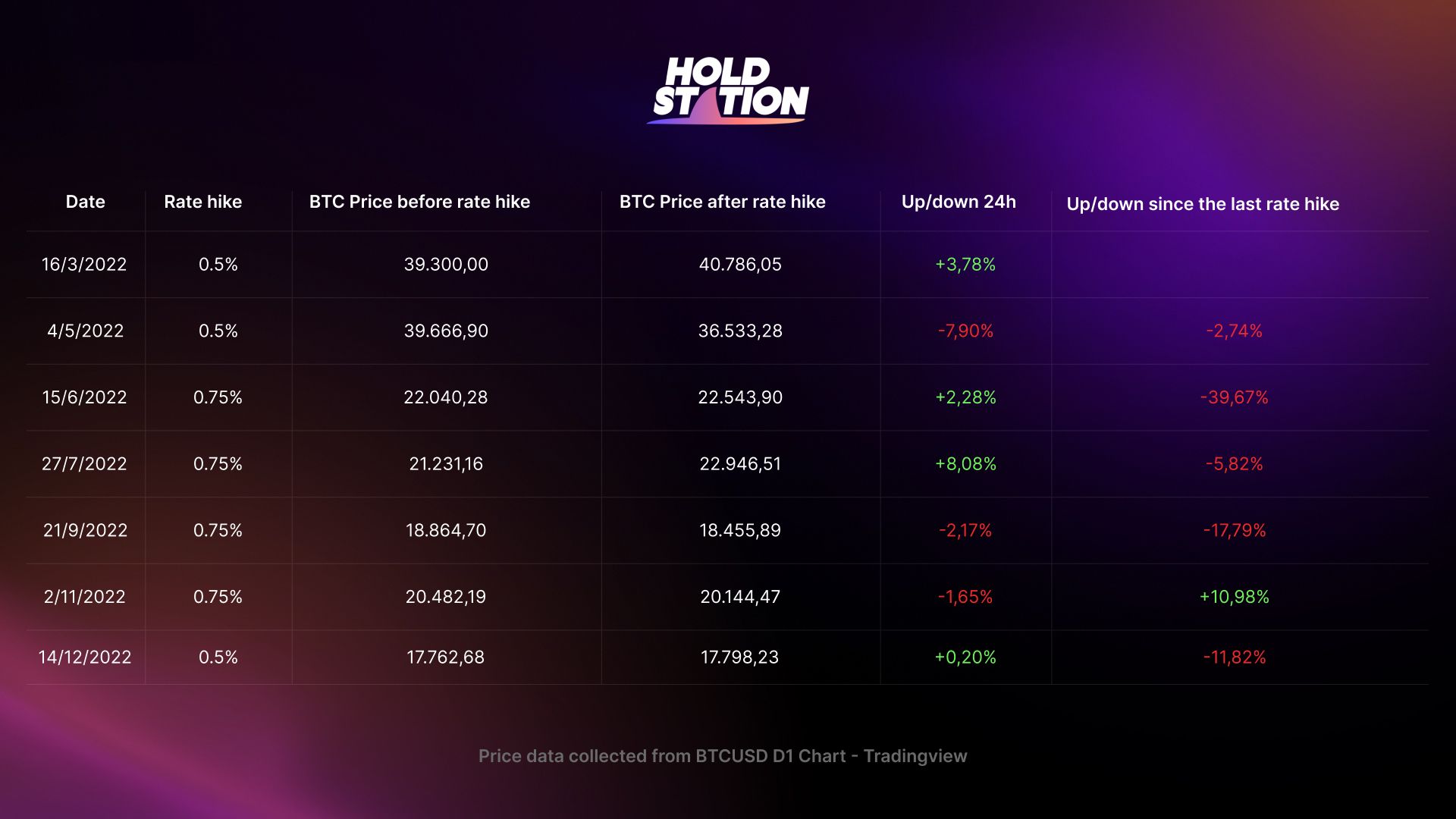

Since that time, each time interest rates are adjusted, they have had certain effects on the entire macro-financial market in general, and the crypto market in particular, and Bitcoin, although there were no immediate reactions. time, but constantly looking for new bottoms after that. 50 basis points increase in interest rate after May 4. And continued to increase by 0.75% four times in a row at the FOMC meetings in June, July, September and November 2022. Before continuing to increase by 0.5% at the last meeting on December 14.

In total, after 7 consecutive interest rate hikes, the Fed has raised the range for the target interest rate to 4.25 - 4.5%, the highest in the past 15 years. This also increased the strength of the US Dollar, causing the DXY index to skyrocket from 96.62 points (February 2022) to 119.92 points in September 2022, peaking in the 20-year timeframe.

Although the inflation situation has somewhat cooled down, along with statements about reducing the momentum of interest rate increases, it is highly likely that the Fed will continue to move towards the target interest rate of 5.1% in 2023.

The end of the bull market cycle

Rising interest rates make borrowing expensive and put an end to a cheap and abundant capital market. And as capital becomes scarcer, riskier assets become less attractive, and money flows toward safer, haven assets.

Crypto in general or Bitcoin for example, in the eyes of many people is still classified as a risky asset, and is heavily influenced by the Fed's monetary tightening policies.

Although there have been miraculous progress and continuously set new peaks in the early and late 2021. As of December 2022, the capitalization of the entire crypto market has "evaporated" more than 2,000 billion dollars, decreasing. From $3 trillion to just about 800 billion, Bitcoin dropped more than 75% from its peak of $69,000 to just $15,500 at its lowest point, with market capitalization falling from $1,280 billion to just $300 billion.

Or Ethereum has also divided more than 4 times the peak price in November 2022 to approximately $1,200 per ETH at the moment.

Of course, it's not just the cryptocurrency market that is affected. The S&P 500 Index has increased 600%, from 770 points to 4818 points, from the lowest low since the financial crisis in 2009 until the end of 2021, despite being affected and dropped suddenly by the Covid-19 pandemic- 19. But only in 2022, the downtrend really started, the S&P500 index fell 25% to only 3577 points, the lowest of the year, although now the market has recovered, but is still falling about about 21%. The MSCI Global Equity Index is also down 20% in 2022. Global bond indexes from leading to emerging markets all fell, IPOs struggled, and deals and mergers also went down in a gloomy year for global financial markets.

Holdstation Wallet - Your Gate to Web3 💜🦈

Make DeFi as easy as CeFi!

Disclaimer:

The information, statements and conjecture contained in this article, including opinions expressed, are based on information sources that Holdstation believes those are reliable. The opinions expressed in this article are personal opinions expressed after careful consideration and based on the best information we have at the writing's time. This article is not and should not be explained as an offer or solicitation to buy/sell any tokens/NFTs.

Holdstation is not responsible for any direct or indirect losses arising from the use of this article content.