FTX has declared bankruptcy, Enron, an energy and technology company, also went bankrupt in a similar way to FTX in 2000 in the aftermath of the dotcom bubble whether the story of FTX's collapse was the trigger. for the blockchain boom in the long-term future? Let's join Holdstation and Banana Research Labs to analyze the correlation between the bankruptcy scene of the 2 leading companies in their fields through this article!

The background of Enron in the 2000s and the context of the current FTX

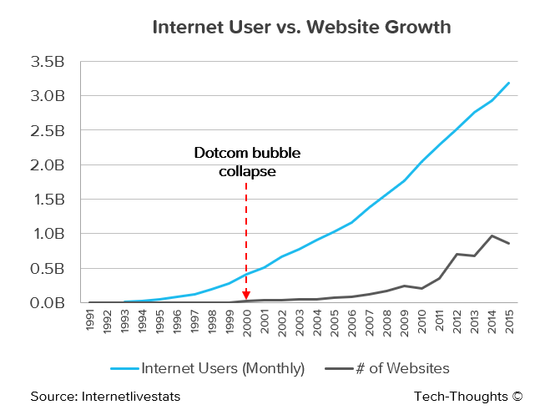

In the 2000s, it can be said that the boom of the internet could match the current crypto in terms of user growth. There are a series of companies with many potential cakes continuously calling for capital, constantly creating FOMO psychology for many investors because the future of the internet is limitless.

The chart above shows that, although the dotcom companies led by Enron collapsed and lost value, the growth rate of internet users still exploded after that event. Companies that demonstrate competence and value then go on to grow explosively.

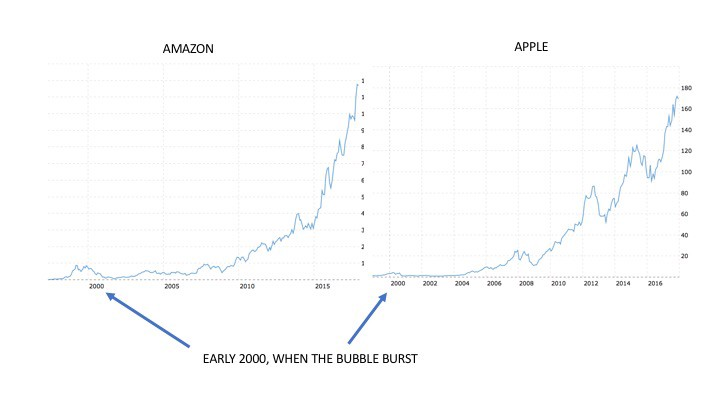

The chart below shows the growth of amazon and apple after the dotcom bubble:

Looking back at the current context of FTX like?

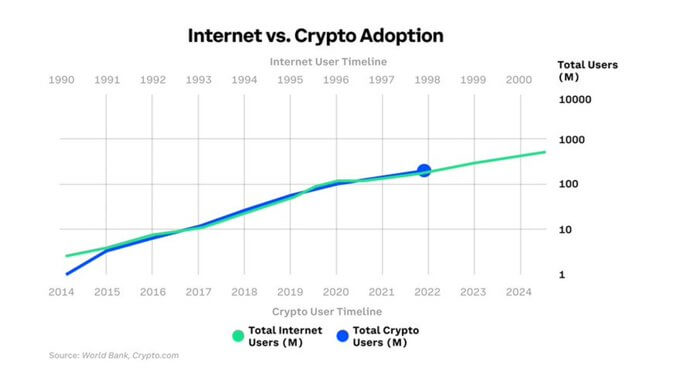

Below is a map of the number of crypto users 2022 with the internet in previous years, you can see the correlation is quite large, and can be compared basically "we are in the internet boom 1999".

As the leading companies in the crypto space continuously create expectations for the market with many different products and technologies, the accumulation bubble leads to many risks. In particular, the collapse of Enron and FTX is closely related to the internal audit, accounting control in the enterprise without close supervision from independent parties. It is these potential risks that lead to business owners making wrong decisions, affecting millions of individual investors and customers. For me, sooner or later FTX should still crash first to reset the game for businesses with internal strength and better products.

Enron's Risky Business Model of the 2000s and What Does It Have to Do with FTX

Enron in the 2000s took on traits that made them more like a Wall Street investment company than an energy or utilities business. The company eventually created entirely new markets that had little to do with the energy market, including futures contracts tied to weather events and Internet bandwidth capabilities. That association with the tech boom was particularly well-timed, and by 2000, the stock had skyrocketed, earning Enron a spot in America's top 10 businesses.

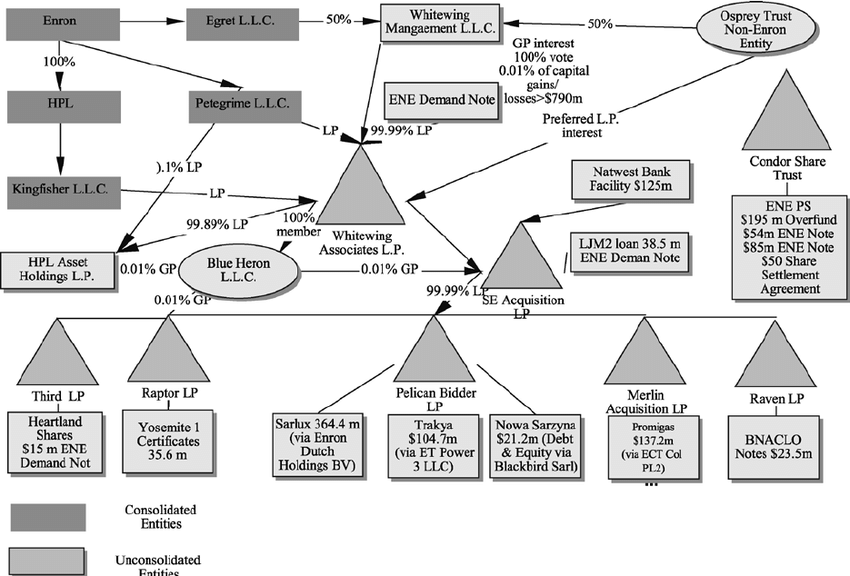

The diagram above depicts how this ENRON Company created a series of related business entities and used accounting gimmicks to hide huge losses and debts.

What about the model of FTX?

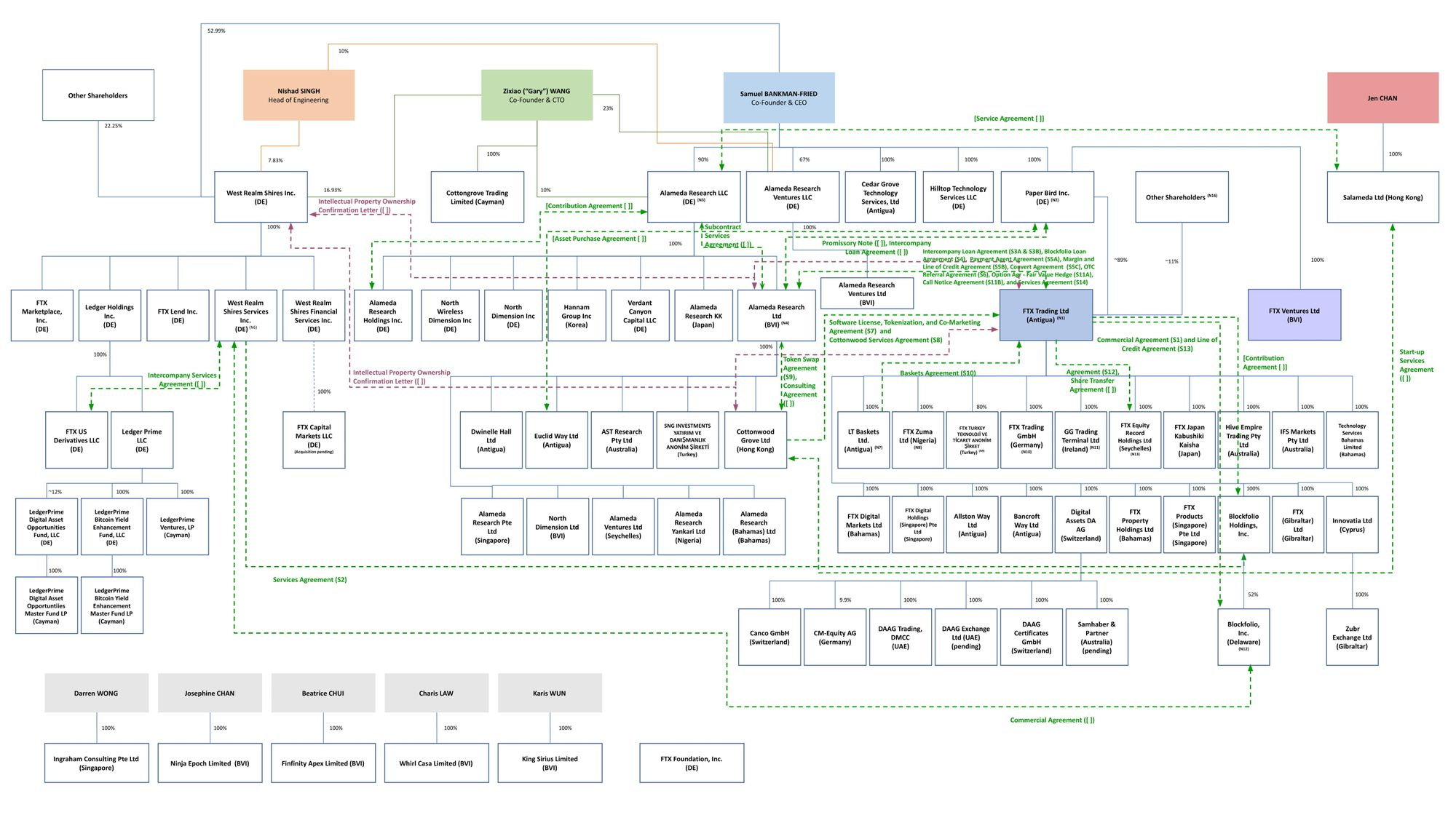

The diagram below is exactly the organizational chart of the matrix of companies that Sam and his associates at FTX, ALAMEDA research created over the past 3 years to rotate capital, use leverage and invest risky.

You'll see Sam and his associates take full advantage of leverage on multinational exchanges and completely whitewash cash flow in a variety of ways.

With an old method of establishing many related business entities, the auditing and accounting practices in enterprises are very complicated. It is possible that many risks arise from this and the lack of information on FTX's leadership leads to wrong decisions. Since then, many rumors have been built up to bring the business to bankruptcy when the "bankrun" situation occurs.

The reckoning of the management of Enron and how Sam Bankman-Fried

Of course, this is completely subjective from the individuals involved.

With Enron as the story of an organized handshake of the highest level of the corporation, typically Jeffrey Skilling and Ken Lay, the leaders of this energy company carried out a huge fraud scheme internally. Arthur Andersen, who at the time was one of the world's famous big 5 accounting firms, eventually revealed that their employees had destroyed the Enron documents, which, if left, could have been used to access denounce this company.

With FTX, typically Sam Bankman-Fried?

As I write this article, I myself have read quite a lot of dramas revolving around Sam, behind them are hidden corners, egos that are enhanced to compete for dominance in the industry.

Did you see the viral tweet about the CZ & SBF conspiracy?

— Mario Nawfal (@MarioNawfal) November 11, 2022

Did you see that I deleted it?

There's a darker story you don't know:

1) During my space,a notable & respected person came on stage & shared a story re Sam (FTX) causing the Luna crash & taking down 3AC. CZ knew this👇

There have been many dark corners from the series of events Luna, 3AC, CELCIUS…. that Sam was trying to destroy the market with cheap mergers. This is still unclear and of course, when the market is so heavily influenced by individuals, it is still very risky for uninformed and sensitive investors.

Following this article, there will be a wave of dominoes crashing of many projects related to or affected by FTX and Sam's business entities.

Personal perspective on the future of blockchain and crypto.

There is still a lot of work to be done and I still believe in the future of blockchain-crypto.

Individuals who write articles will use data from the Gartner Hype Cycle model to give a personal perspective.

As you can see since the dotcom bubble, the market and technology have a strong downtrend for the next 1-2 years. In the following years, as products and technologies proved relevant and users surged, the market exploded again.

Relative to the current context, my view may be that the next 6 months - 1 year will be a difficult period for the market, only "True builder" who are willing to develop good products can survive in the future. next time. From an investor's perspective, this time should accumulate more knowledge, can look for projects for the next cycle and do not forget to accompany Holdstation and BRL.

Banana Research Labs's Linktree: https://linktr.ee/brlvn