ETH after The Merge

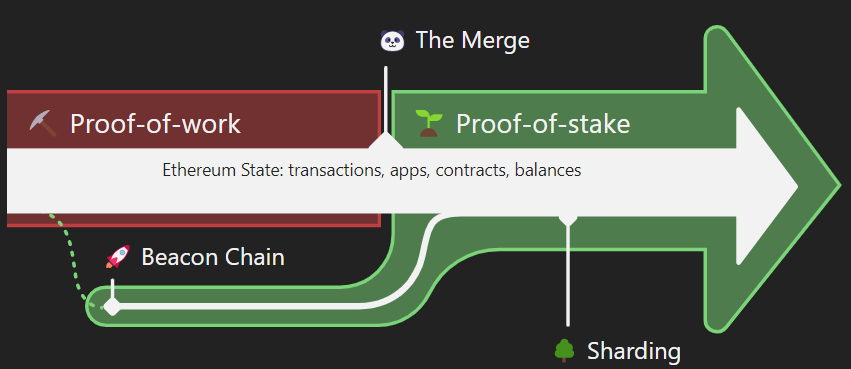

The Mere will be an important event to move Ethereum from PoW to PoS, in more detail, Holdstation has an analysis of this event, which can be read here. But in general, after The Merge we will see:

👉 ETH supply drops every day ~90% ➡ deflation.

👉 Increased staking dynamics (increasing APR).

👉 Selling momentum dropped sharply (because there were no more miners).

All favor a bright future for ETH, however, these are only positive long-term effects. Today we are going to talk about short term expectations for $ETH after The Merge.

The first is a decrease in the supply of ETH, which in the long run is likely to bring deflation. However, when a large amount of new ETH is staked (estimated to be about 10 times the current amount), the amount of ETH supplied as a staking reward also increases accordingly ➡ it is unlikely that the daily supply has decreased that much.

Next, when The Merge is completed, it means that more than 13 million ETH staked on Beacon Chain will be able to be unlocked and released to the market. This is a common misunderstanding, because it is not until the Shanghai staker upgrade that unlocks ETH, equivalent to 6-12 months after The Merge takes place. And even then, the amount of unstake is limited to ~43,200 ETH/day.

In recent days, the market is having a lot of ETH accumulation and leverage, to "hunt for airdrop" ETH PoW after The Merge. Therefore, when the event is completed, it will also be time for these investors to release ETH to the market.

In summary, the short-term expectation of ETH after The Merge is not as positive as the long-term view. On the contrary, there is also a slight negative. To determine more, Holdstation will "look" to see what the smart money of the market is doing with ETH this period.

Shark Tracing

After checking ETH shark wallets on Sharkscan, found that shark wallets still show signs of accumulation. Besides, the sharks cannot transfer ETH to Binance and Coinbase for sale because they have suspended the deposit and withdrawal of ETH and ERC-20 tokens from September 6 to September 15.

For example shark 12806, holding ETH 84% of the portfolio with a continuous collection.

Or Shark 13019 holds 85% of the portfolio and has been continuously adding more recently.

When take a look at the Ethereum sharks overview, the data shows that the sharks tend to accumulate more than they transfer, with a few moving in the form of an OTC sale or selling and transferring to other wallets. Maybe the big hands in the market are still waiting for the opportunity to unlock the deposit and withdraw so they can sell and discharge.

To sum up, the big sharks have mostly had rallies since before when ETH price returned to the $800-$1000 mark. This period with the long-term expectation ETH will continue to grow, so this is most likely the action of the sharks. However, in general, the ETH cash flow of the largest 2000 sharks on Ethereum, the amount of ETH being withdrawn from the wallets is dominant compared to the deposit. So with Margin or Future positions, investors should have contingency plans and protect their assets.

Notable figures ahead of The Merge

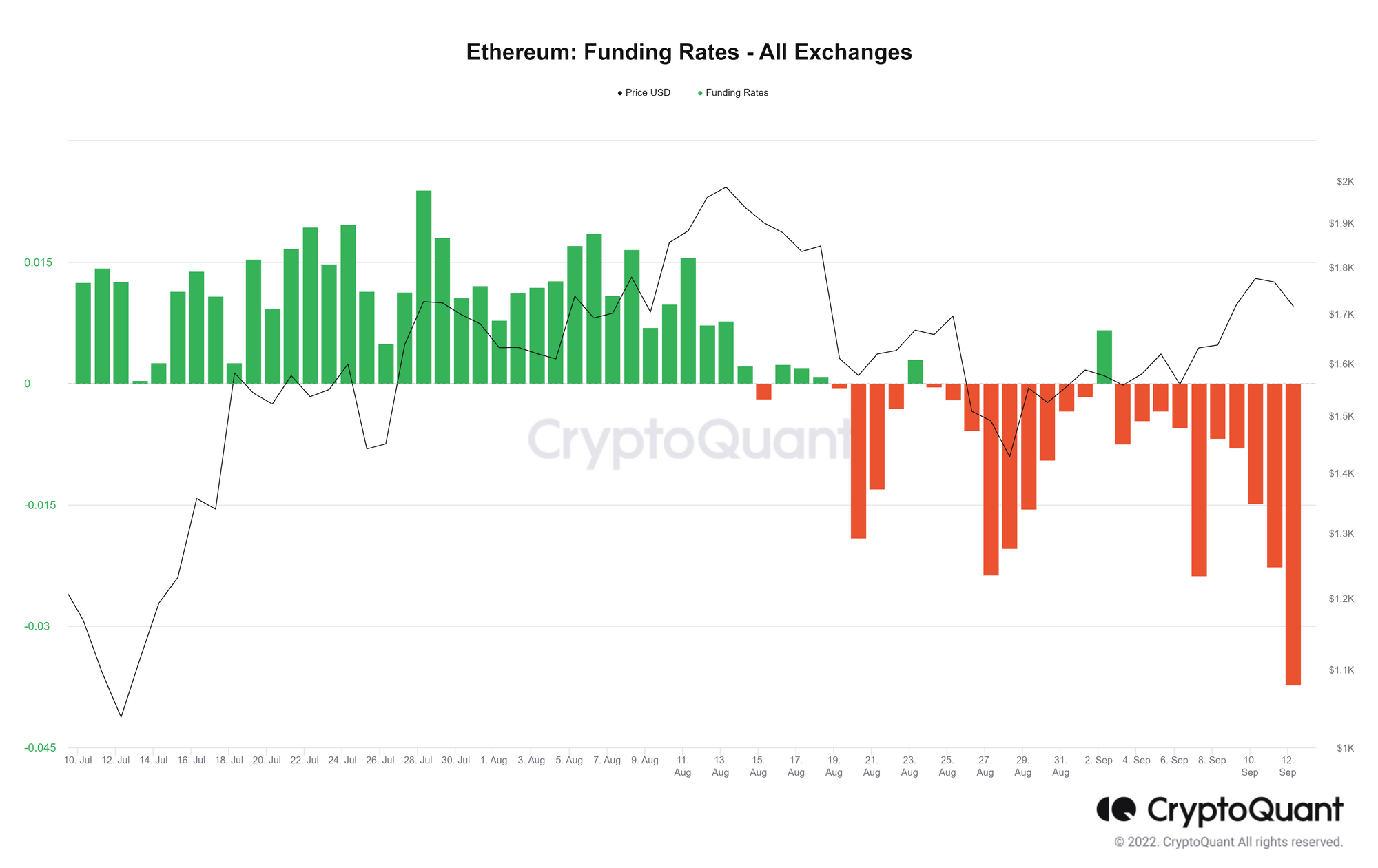

According to data from CryptoQuant, the number of open positions - Open Interest of #Ethereum (including long and short positions) also remains high, sometimes close to the peak in May/21. Proving that investors are betting high on the upcoming The Merge event on both sides.

However, the Funding Rate #ETH index in the past 1 week is occupying a high negative part, showing that the betting sentiment of the bears is still clearly overwhelming. The fact that ETH shorts overwhelm the Longs could be a hedging fund action by investors or market sharks. Investors will buy spot ETH to ride the fomo wave of The Merge, but they also push stablecoins to derivatives exchanges and short ETH as a way to reduce risk and protect their assets. Through here, investors as well as sharks always leave themselves a way back.

Exchanges and Lending Protocol are cautious about lending $ETH ahead of The Merge

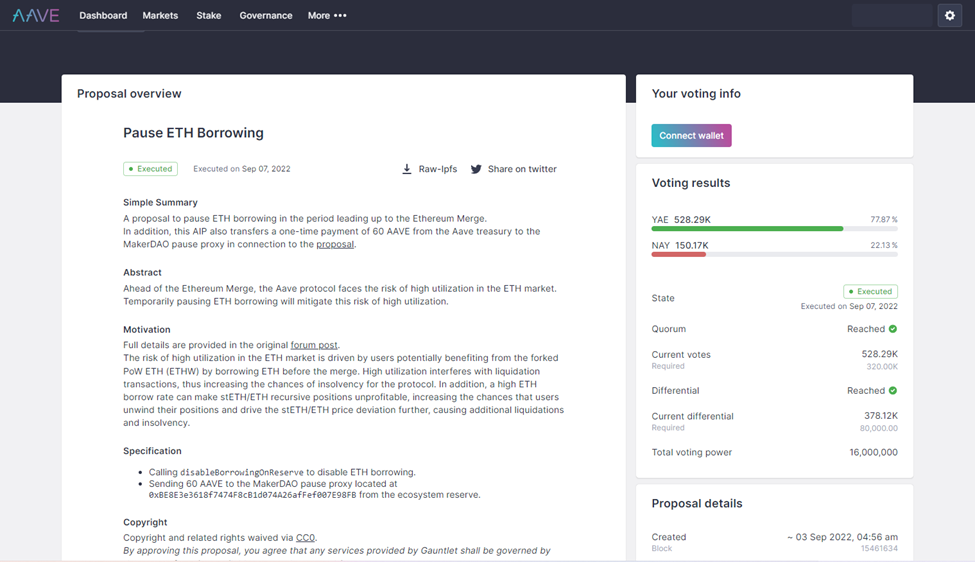

The first can be mentioned that the "big man" AAVE has suspended ETH lending since September 6 until The Merge event officially takes place. Next is Compound tightening the volume of ETH lending combined with an increase in lending interest rates. Details of AAVE's ETH lending halt and Compound's ETH lending volume tightening can be found here.

The move to suspend or tighten the ETH lending volume of lending protocols shows that the big players are also completely ready to prepare for a bad scenario about the situation of the post-The Merge market.

Besides the move of lending protocols, major exchanges like Coinbase or Binance also have their own moves to prepare for bad situations. In it, on August 16, Coinbase announced on its social networking site Twitter that it will suspend $ETH deposits and withdrawals at the time of the consolidation event.

Please note that the suspension will last until The Merge is complete.

— Binance (@binance) September 5, 2022

Deposits and withdrawals on the impacted networks will resume once the networks are deemed stable.

More details here ⤵️https://t.co/r0HeQZbF7m

Or Binance has also suspended the deposit and withdrawal of $ETH and $wETH in certain networks. Binance's suspension has even been around since September 5, and according to the announcement, deposits and withdrawals will return to normal once the consolidation process is complete.

Conclude

In general, the closer you get to The Merge, the more sharks and wallets on the market tend to take less action. Partly due to the restriction of ETH from exchanges and DApps, but the main reason is still to limit the strong volatility of ETH after The Merge. In recent months, we have seen a strong market rally that goes hand in hand with The Merge story, as this will be a powerful catalyst for Ethereum in the long run. However, in the short term, the money flow is tending to speculate on ETH before The Merge to receive ETH PoW, and the possibility of leading to an ETH "discharge" rhythm soon after. Should return to ETH right after The Merge, Holdstation still has a more negative view.