The development team of Curve Finance - the second largest decentralized exchange on Ethereum - has released official documents and code related to this organization's upcoming stablecoin - predicted to be called crvUSD.

According to the whitepaper moderated by founder Michael Egorove, crvUSD will have the same functionality as DAI - MarkerDAO's stablecoin. Users can mint the stablecoin by depositing excess collateral in the form of a cryptocurrency loan in reserve.

However, with the model (collateralized debt position - CDP) that has been widely adopted across many lending platforms, if the collateral price drops and reaches a certain mortgage rate, your mortgage will be liquidated immediately.

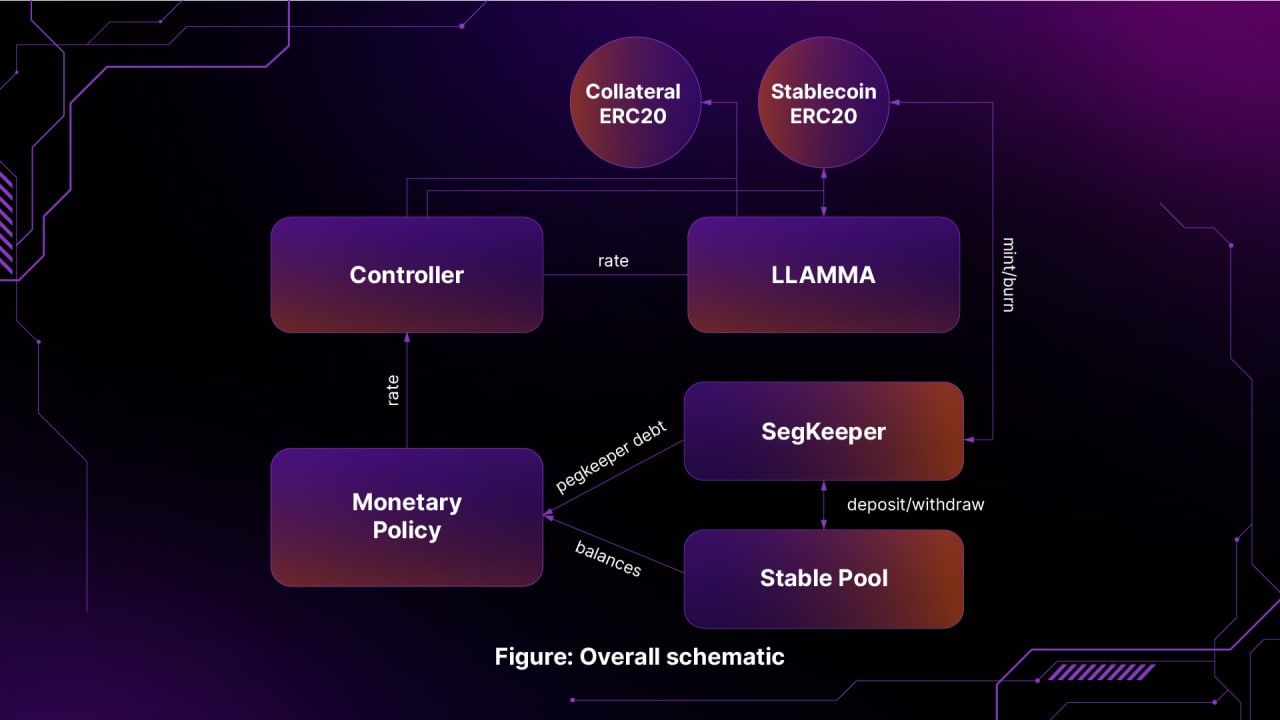

Therefore, Curve Finance has implemented a new mechanism to reduce the risk of this problem - The lending-Liquidating AMM Algorithm (LLAMMA).

What is LLAMMA?

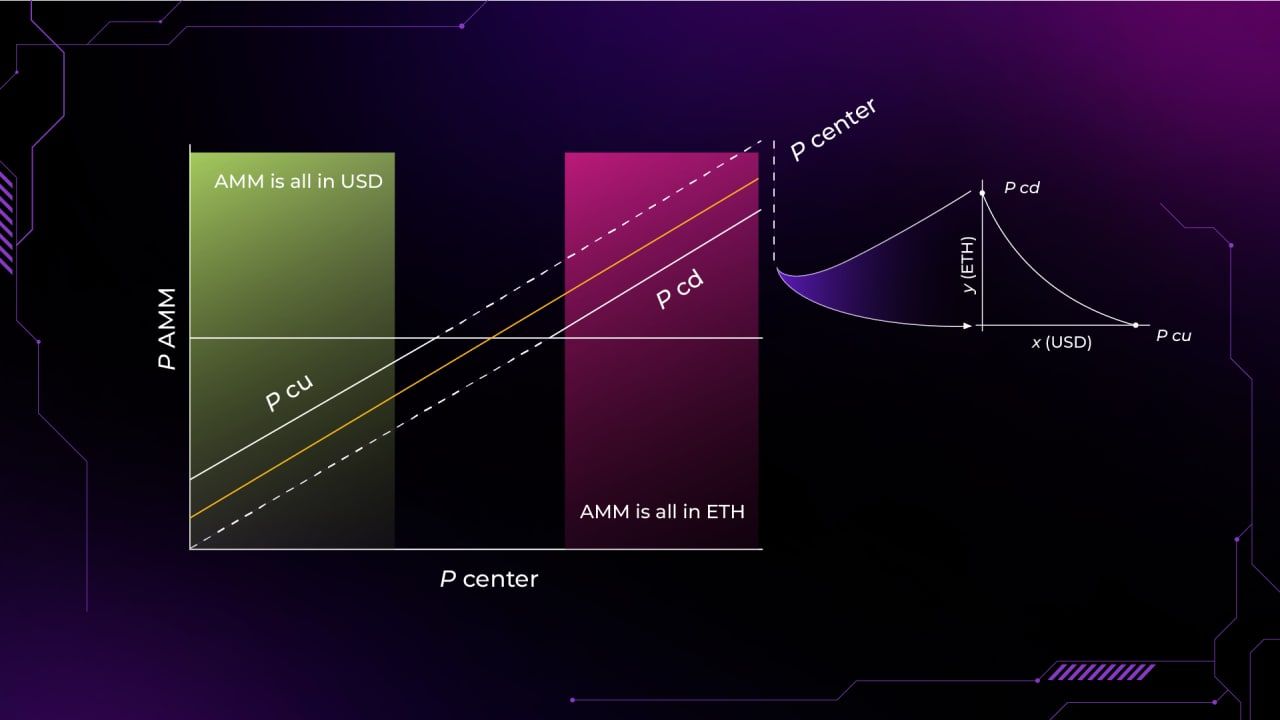

The new innovation works as follows, first, you use collateral to borrow stablecoins, the collateral will now be 100% of the initial assets you deposited. If the price of this asset falls, LLAMMA will automatically turn your mortgage portfolio into $crvUSD. And when the mortgage price increases, the $crvUSD is now used to buy back the previously swapped mortgage. From there, instead of immediate liquidation, the process will take place continuously in a certain price range, helping to limit the possibility of asset loss as well as easily manage your position.

The price range here means that instead of specifying a liquidation price, your mortgage will be divided into several liquidation price zones. When the price drops to each price zone, the swap will be activated in turn.

An example of the process would go like this. You deposit 5 ETH and the $1000 - $1050 liquidation price zone is divided into:

- 1000 ($1000 - $1010): 1 ETH

- 1010 ($1010 - $1020): 1 ETH

- 1020 ($1020 - $1030): 1 ETH

- 1030 ($1030 - $1040): 1 ETH

- 1040 ($1040 - $1050): 1 ETH

When the ETH price drops to the $1040 - $1050 zone, your position will begin to gradually liquidate by automatically converting 1ETH to 1040 $crvUSD (~$1040) and your collateral now includes: 4ETH + 1040 $crvUSD to secure the amount of crvUSD that can buy back the debt.

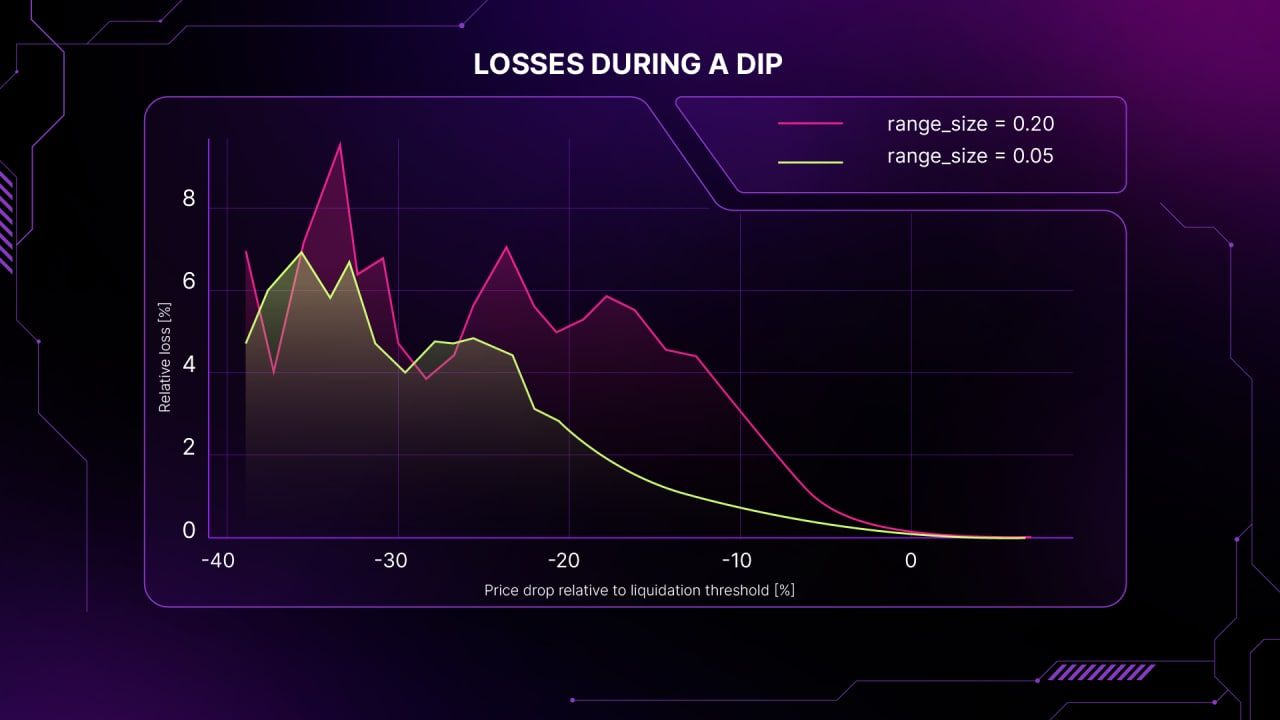

The liquidation zone will be divided into at least 5 and up to 50. A larger area means that the position will be liquidated soon but the process will take place gradually, and conversely, a smaller price area will result in a quite sudden liquidation process.

What is PegKeeper?

Another important point is that LLAMMA uses the ETH/USD pair price source to be able to trade $crvUSD above or below the peg. If the price is above the peg, PegKeeper automatically mints crvUSD and sends it straight to the Curve Pool. This helps increase liquidity while also generating transaction fees. When the price falls below the peg, crvUSD is withdrawn from the pool and burned to reduce the supply. This mechanism is somewhat similar to the stablecoin FRAX of the Frax Finance platform (Fractional-Algorithmic Stablecoin - stablecoin that both collateralized real assets and relies on algorithms).

In addition, each collateral can act as an AMM for the crvUSD trading pair. For example, collateralized ETH ⇒ automatically creates a pool of the $ETH / $crvUSD pair so that traders can arbitrage and trade.

⇒ If the network expands, this will increase the utility of stablecoin $crvUSD when integrated with more trading pairs. At the same time attract cash flow to the Curve ecosystem and platform revenue can grow.

⇒ CRV token holders will also to some extent benefit from increased allocation revenue and trading pairs voting power.

Summary

Similar to the stablecoin model DAI - which is quite stable - and adding new ideas, crvUSD is likely to be a good catalyst for the development of the entire Curve Finance ecosystem. Currently, Curve Finance has not announced the details of the implementation time.