December, a month of important news and holidays. A series of events such as the last FOMC interest rate hike of 2022. Holidays like Christmas or New Year are also approaching. Is there going to be a drastic move from the price of BTC? Let's analyze with Holdstation through this article!

Important events

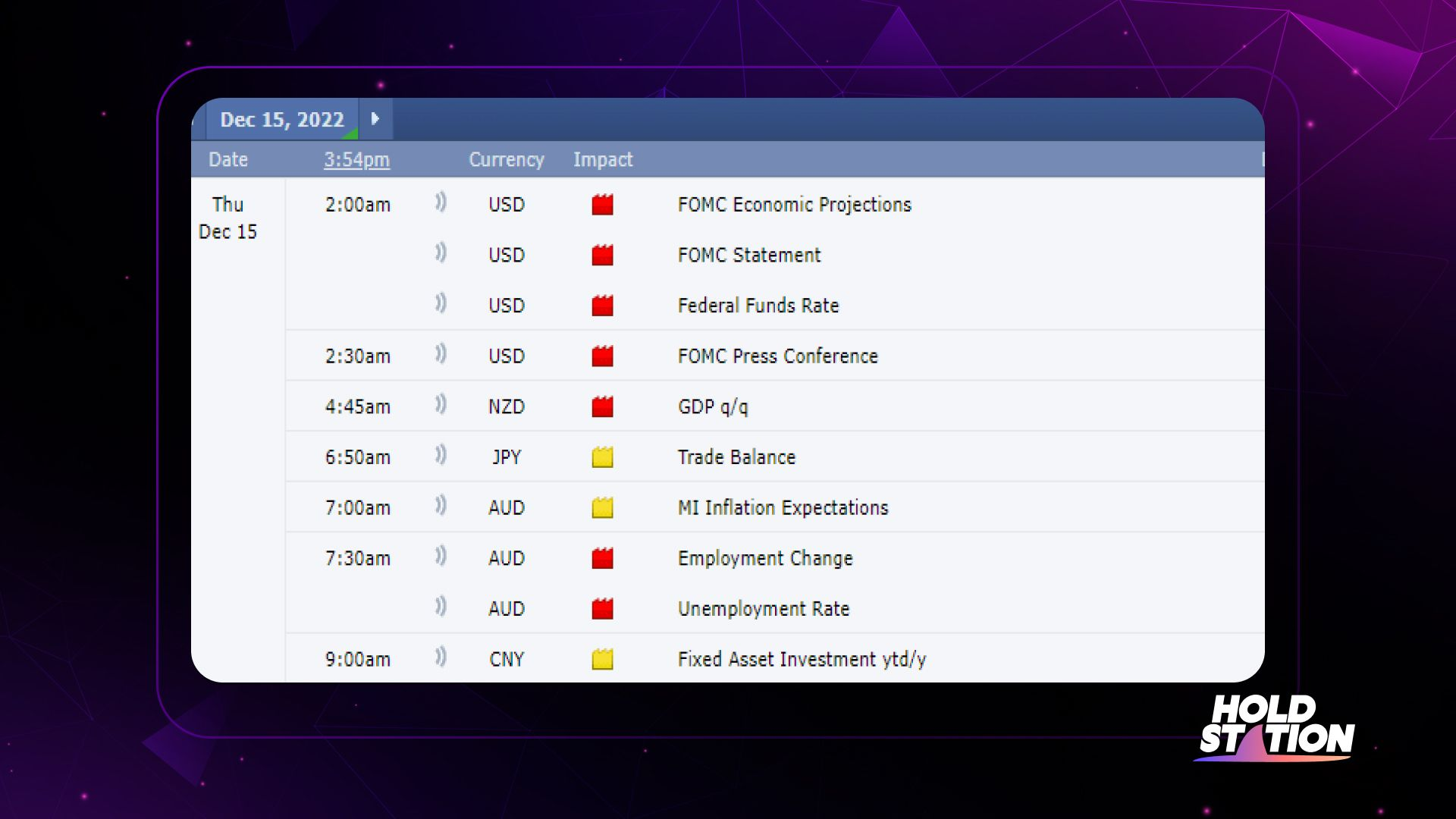

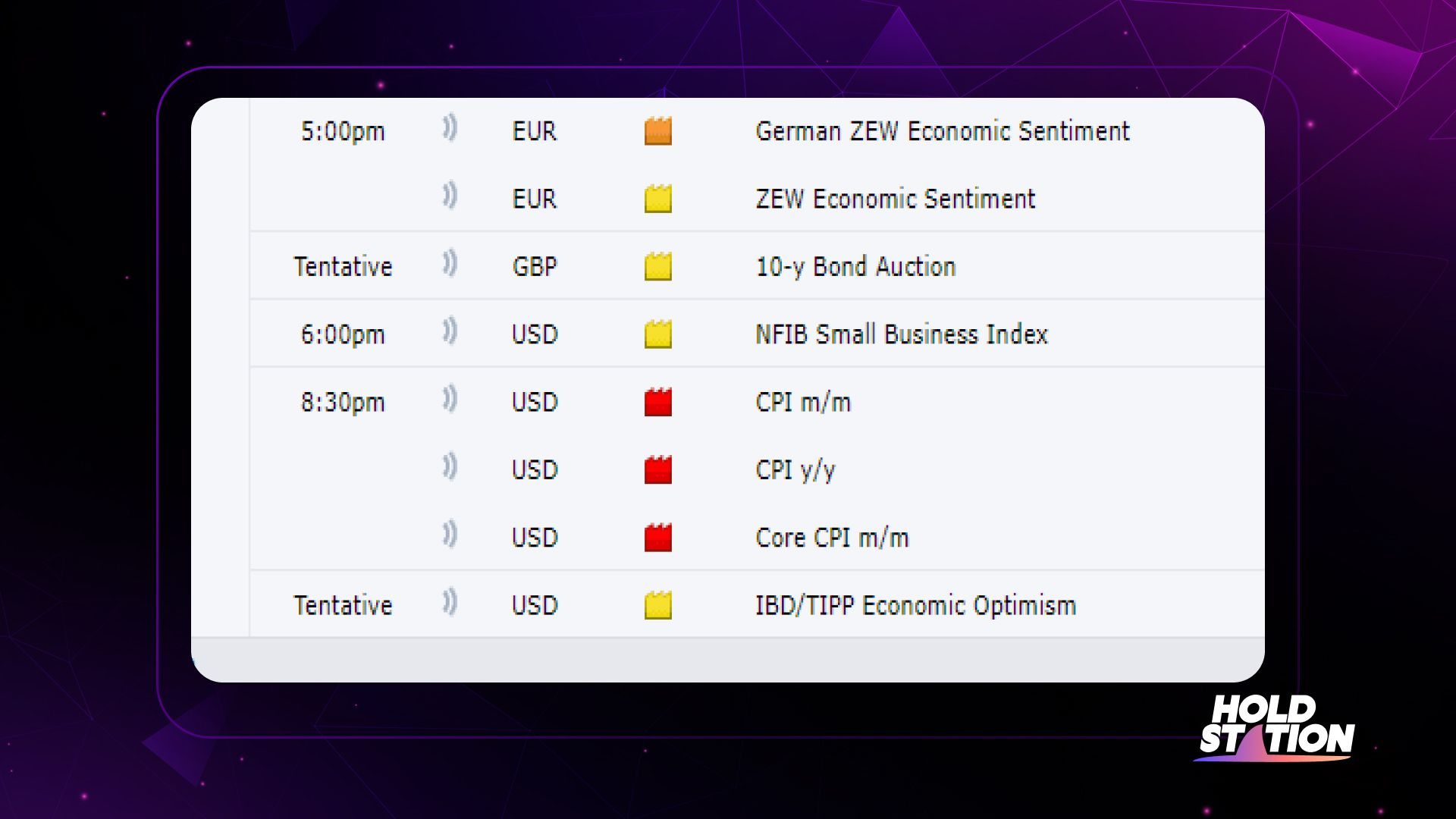

This coming December, a series of news such as the last rate hike by the Fed, core US CPI news. How will these news affect the price of BTC?

First, let's analyze to make predictions with the upcoming important Fed rate hike that will almost determine the direction of BTC until the end of 2o22. Currently, the whole market is expecting a 50 basis point increase in the Fed's interest rate. However, will the Fed (the US Federal Reserve) reduce the rate of interest rate increase as expected by Mr. Powell in his speech at Brooking Palace last week?

Let's first look at the nonfarm payrolls report, before the nonfarm employment change rate was released. The Federal Reserve Rate sees an 85.5% chance the Fed will raise rates by 75 basis points in its last rate hike this December. After the ADP (non-farm employment change index) was released, it increased to 92%. It shows that the general situation of inflation is still tense. Especially at the end of the year, when people go shopping for the holidays, the increased demand for goods and the increase in commodity prices will also be a reason for the FED not to slow down the rate hike this year but to Delayed to 2023

Besides the news about the Fed's interest rate increase on December 15, there was also news about CPI (Inflation Index) 2 days before. If the CPI news is not good and the interest rate news is similar, then the market situation will enter a 2-day domino series and it is very likely that BTC will find a new bottom of this year.

What will the script be like?

If we look at the current market, in terms of DXY and gold price, we can see that gold is entering a long-term bearish pattern as the large 1-month chart shows a double top pattern with a very clear divergence signal. Obviously, the rebound of the D1 frame is normal, when the gold price has had a strong drop from the top. After a successful backtest, the gold price is likely to turn down when the FED has no intention of reducing interest rates, the value of the dollar will continue to increase, the short-term vision is also the end of this year.

The upcoming 13th will be the beginning of a wave from now until the end of the year. News on CPI will show whether the increase in interest rates has had any effective impact on the economy. inflation control. So news about interest rate increase can almost only happen in 2 scenarios: increase as forecast or increase more than forecast. Through many instant news reactions to the present time, both of these cases will not be good for BTC anymore.

What should investors do?

From a personal perspective, the writer is inclined to the scenario that BTC will have a big price drop at the end of the year. The time from the time of writing to the CPI news is still about 6 days away. Therefore, the BTC price is likely to still be a sideway in a small price range. If BTC collapses like this scenario then we will probably see a BTC at 14500 for the first time in 2 years. Investors should pay attention to important milestones as well as prepare BTC scenarios to preserve their capital as well as optimize profits.

Disclaimer:

The information, statements and conjecture contained in this article, including opinions expressed, are based on information sources that Holdstation believes those are reliable. The opinions expressed in this article are personal opinions expressed after careful consideration and based on the best information we have at the writing's time. This article is not and should not be explained as an offer or solicitation to buy/sell any tokens/NFTs.

Holdstation is not responsible for any direct or indirect losses arising from the use of this article content.