In the past 24 hours, Binance continuously got FUD related to USDC withdrawal, BUSD lost its peg, and the difference of BUSD between Ethereum and other chains led to community doubts regarding Binance's proof-of-reserve, and FUD Binance's incident is the same as the recent FTX.

CZ - CEO of Binance Speaks Up

After the above incident, CZ continuously tweeted to explain the situation and reassured the community through those tweets.

These are 1:1 conversions, no margin or leverage involved. We will also try to establish more fluid swap channels in the future. In the meantime, feel free to withdraw any other stable coin, BUSD, USDT, etc. 🙏2/2

— CZ 🔶 Binance (@cz_binance) December 13, 2022

Explaining the FUDs Surrounding Binance

On the morning of December 14, 2022, Austin Campbell - Head of Portfolio Management of Paxos, posted on Medium explaining to the community about Binance FUDs.

Founded in 2012, initially as a crypto exchange (itBit), the blockchain infrastructure provider has built a backbone for PayPal and Venmo's crypto brokerage services, allowing their customers to buy, hold and sell crypto. Societe Generale, Credit Suisse, and Nomura Instinet have used Paxos' software to settle trades directly with each other. Paxos, since its founding, has embraced transparency, oversight, and regulation. In May 2015, Paxos became the first chartered trust in the United States to operate in crypto assets. Paxos hopes to attain a clearing-agency license from the U.S. Securities and Exchange Commission. Paxos Trust Company, LLC (Paxos Trust) is a limited-purpose trust chartered and regulated by the New York State Department of Financial Services. The firm also issues a U.S. dollar-backed stablecoin called Pax Dollar (USDP).

Why Did Binance Stop USDC Withdrawals?

#Binance is conducting a token swap involving $USDC. As a result, $USDC withdrawals are temporarily paused.$USDT & #BUSD withdrawals are available and unaffected. $USDC withdrawals will reopen once the token swap is completed. https://t.co/CxgCGBUJEA

— Binance (@binance) December 13, 2022

Firstly, as a general statement, an adequately designed fiat-backed stablecoin should take customer money and put that money in safe reserves in the traditional financial system. The problem is that those reserves run on the rails of the conventional financial system. Therefore, all the traditional banks only operate on business days, during banking hours (9 am -5 pm, New York time), and on days when banks are open (so not weekends and not holidays). Eventually, Binance can not meet the high demand of customers who want to withdraw USDC because the reserve of Binance is in a traditional bank.

Secondly, Binance engages in auto-conversion when there are deposits onto its platform. That means if a user deposits USDC, TUSD, or USDP to Binance, Binance will take those tokens, redeem them for fiat, and use them to mint BUSD through Paxoxs.

The complication here is that Binance also allows users to withdraw back to other coins, so if Binance receives $1B of withdrawal requests for USDC, they need to do the following:

- Redeem BUSD against the BUSD trust

- Mint USDC with the proceeds from the BUSD redemption

- Sent the USDC to the user

In the case of Binance suspending withdrawals for USDC, Austin Campbell can confirm that lack of off-hours liquidity was the culprit for this action.

BUSD On Ethereum And Other Chains

The NYDFS, the regulator overseeing Paxos, has only approved issuing BUSD on the Ethereum blockchain. However, as many who use ETH know, it's expensive, clunky, and old. Other blockchains (BSC, AVAX, TRON, SOL, Polygon, etc.) are used, some of which are faster and cheaper (even if there are other tradeoffs).

Paxos’ USDP and BUSD have a primary prudential regulator to ensure there are attestations, audits, and examinations of controls at or above the standard of traditional financial institutions. This is one way we're building trust in #blockchain. More: https://t.co/zWNgZcVQk9 pic.twitter.com/uIVgM5WWEb

— Paxos (@PaxosGlobal) December 12, 2022

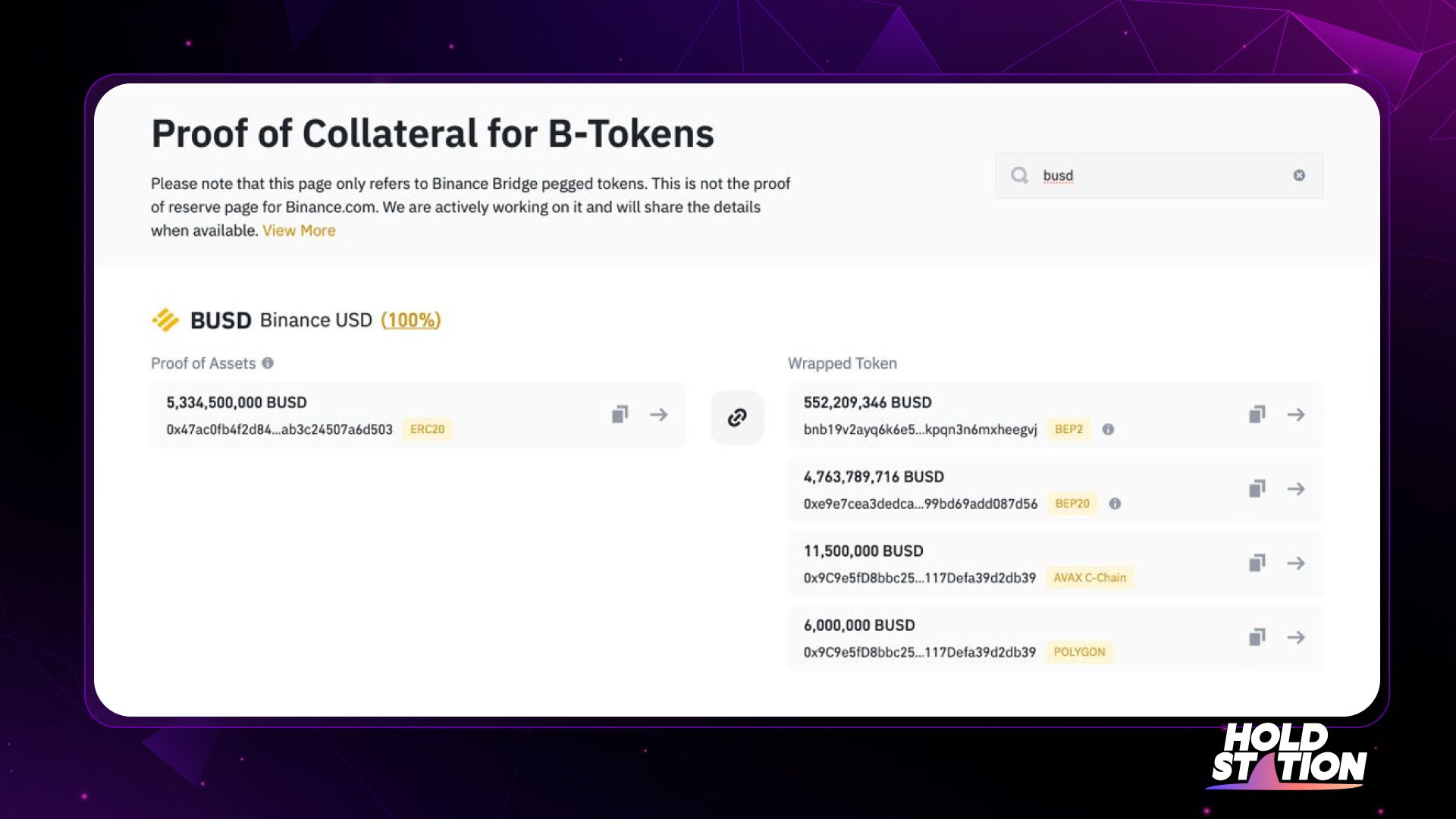

Given the lack of native issuance, Binance has taken the step to bridge BUSD privately onto those chains. That token is the BUSD pegged or wrapped token. If the community wants to see the on-chain reserves held for these tokens, you can find them here by searching for BUSD.

Personal Reviews and Summary

After all the FUDs that Binance got involved with, the world's leading exchange is back to normal, according to the Binance CEO's tweet.

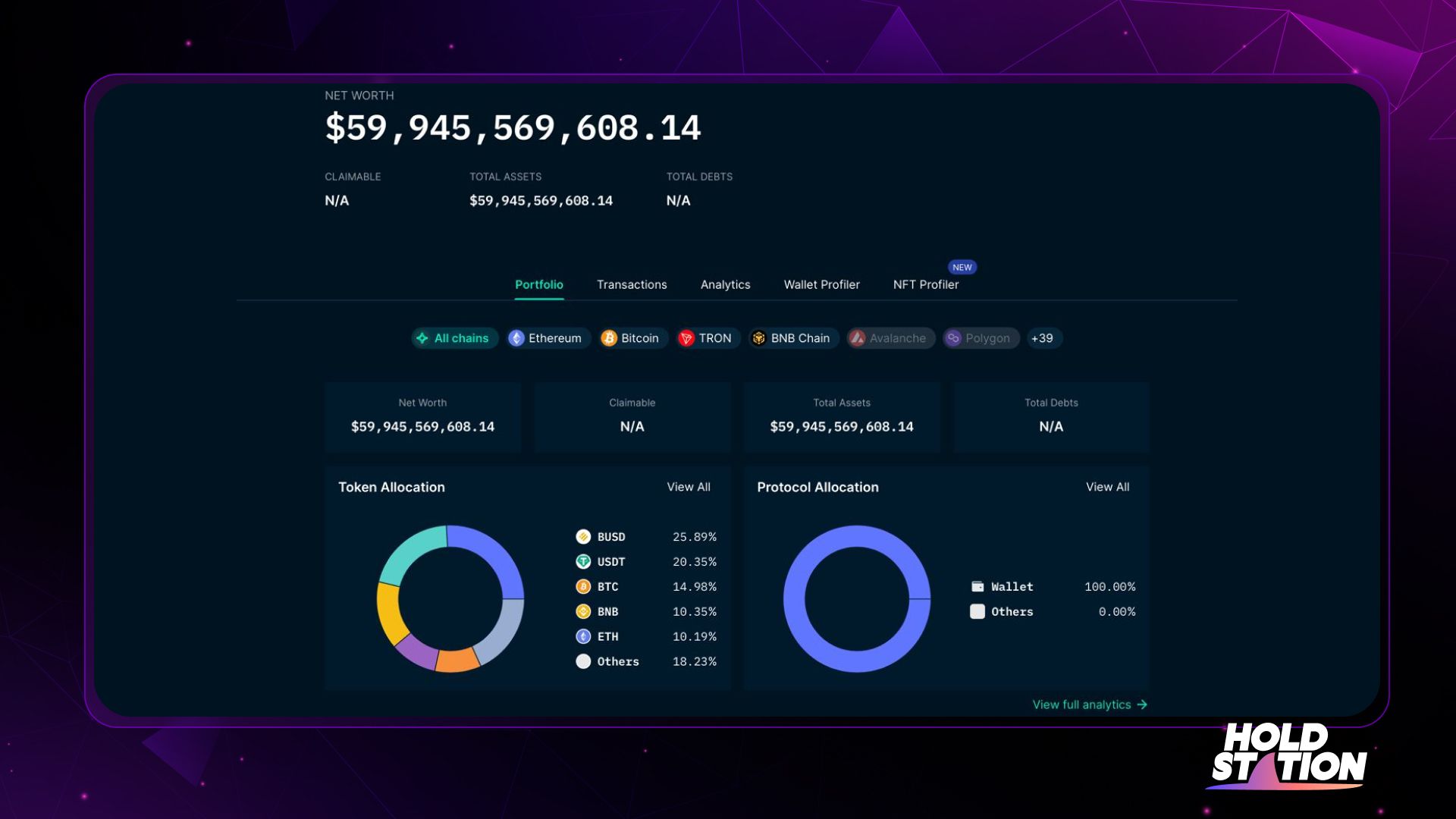

Binance has the most significant proof-of-reserve source in the crypto market, with about $60 billion, and is audited by Mazars. Therefore, investors should not be alarmed by unverified FUDs and rush to withdraw money from this exchange.

Besides, the problem of lack of liquidity when a series of users withdraw assets from this exchange can be completely understood when Binance's reserve is entirely in the bank. Mass withdrawals of assets outside office hours can cause liquidity shortages like Binance experienced yesterday, unrelated to Binance's proof-of-reserve problem.

Finally, investors should be cautious and authentic about FUDs so that there are ways to move their assets to safe places like cold wallets or other exchanges when something goes wrong.

Disclaimer:

The information, statements and conjecture contained in this article, including opinions expressed, are based on information sources that Holdstation believes those are reliable. The opinions expressed in this article are personal opinions expressed after careful consideration and based on the best information we have at the writing's time. This article is not and should not be explained as an offer or solicitation to buy/sell any tokens/NFTs.

Holdstation is not responsible for any direct or indirect losses arising from the use of this article content.