Initial move

The collapse of FTX stems mainly from the small amount of illiquid assets. When Alameda was found out to be illiquid, the market showed that FTX's reserves were also almost nothing but FTT, SOL and very little cash, leading to a catastrophic end.

Therefore, to create confidence for investors and the market to avoid asset withdrawal / sell-off. That same day, Binance went public with its balance sheet and all of its assets. Next are the exchanges OkeX, Kucoin, Gate, Crypto.com, Bitfinex, Huobi, Deribit ...

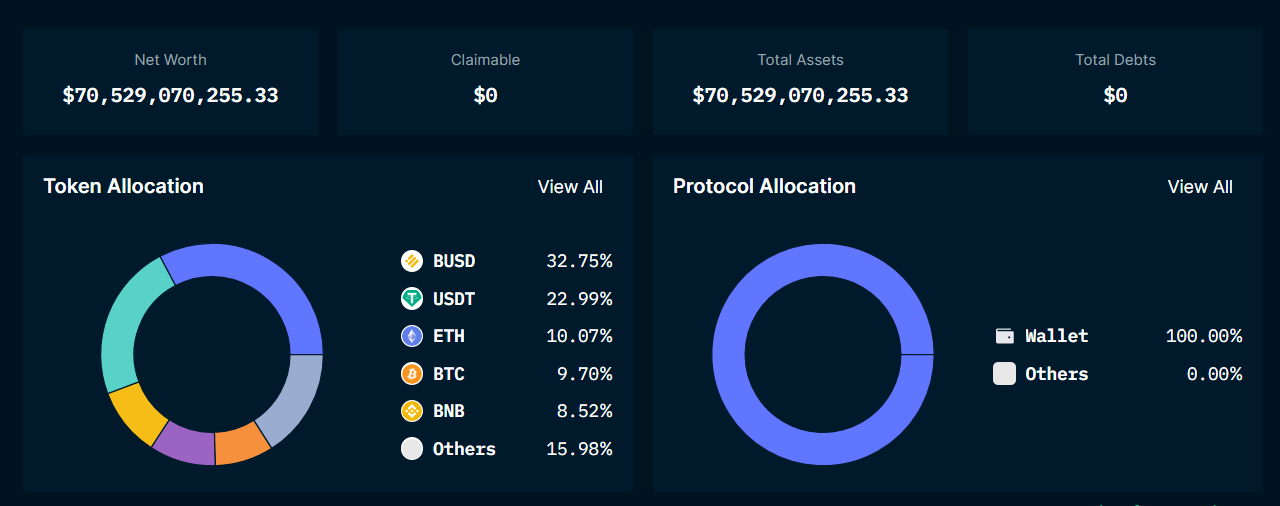

The above example is the assets of Binance, with a total value of up to 70 billion USD. Of which, more than 50% are stablecoins and 30% are bluechip assets such as BTC, ETH, BNB. It can be seen that the quality of Binance's assets is extremely good. Similarly, the smaller exchanges only have total assets of about $2-10 billion but also show investors that they have quality and transparent reserves.

Details of assets of other CEX exchanges can be viewed here.

Shady actions

Crypto.com

It will be fine and nothing will happen, if there was no accusation. Crypto.com is said to have sent 320,000 ETH to the Gate exchange on October 21, Gate published its assets on October 28 and then immediately transferred 285,000 ETH back to Crypto.com.

Confirmed: crypto .com "accidentally" sent 320k eth of user deposits to Gate .io on Oct 21st

— Shegen - overthrow the banks (@shegenerates) November 13, 2022

Oct 28: Gate shows "proof of reserves" & then sends 285,000 eth back

This was topping up for the proof. Gate and crypto .com are fucked?https://t.co/jYyq1CIGOs https://t.co/RTWEYgTCJA pic.twitter.com/U9PJdHfTDW

To answer this, today Kris, CEO of Crypto.com spoke up. He said that the assets were supposed to be moved to a cold wallet, but they mistakenly transferred it to Gate and after some talk, Gate returned the assets.

It was supposed to be a move to a new cold storage address, but was sent to a whitelisted external exchange address. We worked with Gate team and the funds were subsequently returned to our cold storage. New process and features were implemented to prevent this from reoccurring.

— Kris | Crypto.com (@kris) November 13, 2022

However, this answer leaves more and more questions for the community. How could such a tightly managed large sum of money be "transferred by mistake"? Why did the asset was transferred right before the audit, and if there was a mistake, where did the 35k ETH left go?

As announced by Crypto.com, currently all user assets will be stored in Ledger cold wallets. However, looking at the activity of this cold wallet, we will see a lot of suspicious activity, and it is still uncertain whether the assets are really stored on the cold wallet? According to famous analyst, Adam Cochran, these wallets have a lot of shady transactions with other CEX exchanges such as Gate, Huobi, Gemini, Celcius, ...

1/8

— Adam Cochran (adamscochran.eth) (@adamscochran) November 13, 2022

I'm going to need an explainer on the Crypto .com cold wallet set up?

Decided to poke at wallet 4 on Etherscan and here is what I saw: pic.twitter.com/hBvD1doFbI

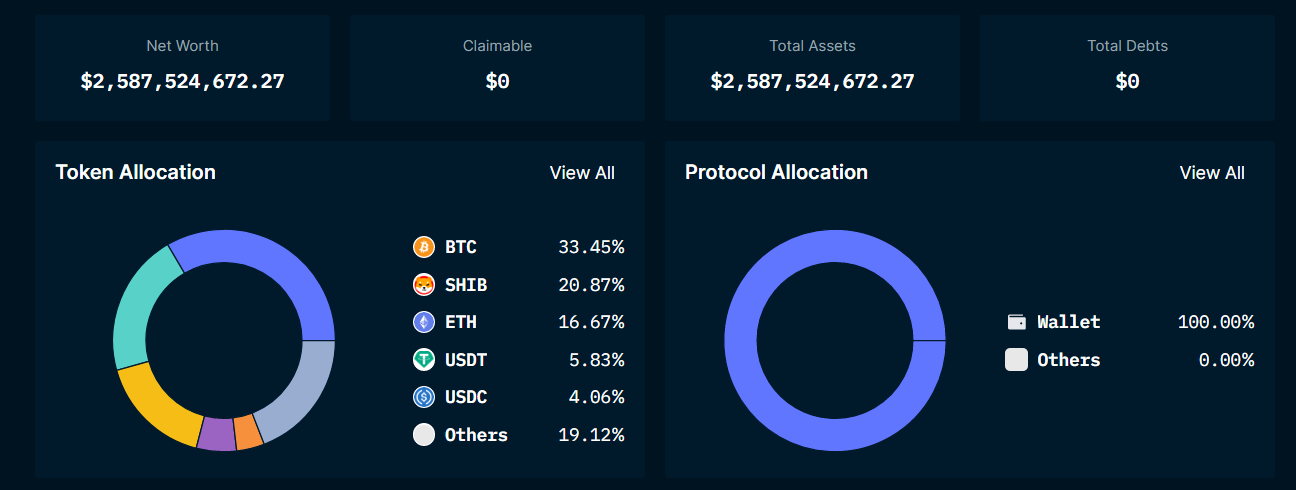

And don't forget that, according to data from Nansen, of the $2.5 billion in Crypto.com assets, more than 20% is $SHIB, a highly volatile memecoin. Although this data could have been "beautified", it is easy to see that there is something wrong with the assets of this CEX exchange.

Huobi

Not only Crypto.com, Huobi is also a questionable exchange. According to a source from Wu Blockchain, after announcing the asset with 14.858 ETH in reserve. Huobi quickly transferred 10,000 ETH back to Binance and OKX. An action similar to that of Gate and Crypto.com.

After Huobi released the asset snapshot of the asset reserve, 10,000 ETH was transferred from 0xca...c3fc (Huobi 34) to Binance and OKX deposit wallets. The Huobi 34, which had 14,858 ETH at the time of the snapshot, currently has only 4,044 ETH left. https://t.co/wrphZxadBM pic.twitter.com/B2lRXMF8su

— Wu Blockchain (@WuBlockchain) November 13, 2022

Huobi has stated that this is just the withdrawal of a large whale on the exchange, and this is normal. But the community did not think so, reflected in the fact that the price of $HT was dumped strongly yesterday and returned to the area before being bought by Justin Sun (time frame at the time of writing). In the last two days, USDD, the stablecoin used by Sun to replace HUSD for Huobi, has also lost its peg and sometimes fell to $0.89. The USDD-3CRV pool on Curve is currently more than 80% of USDD. It is easy to see that this exchange is also falling into a state of questionable assets as much as Crypto.com.

Summary

Although nothing is certain, shady actions during this difficult market show a great risk. Investors who have assets on the exchange/invest in tokens related to these CEX exchanges should pay close attention. In a downtrend, keeping money is always a priority over making money. Especially when, CZ himself also warned about such cases.

If an exchange have to move large amounts of crypto before or after they demonstrate their wallet addresses, it is a clear sign of problems. Stay away. Stay #SAFU. 🙏

— CZ 🔶 Binance (@cz_binance) November 13, 2022